Lease to Own Modernized

Redesign the application process

Role: Director of UX

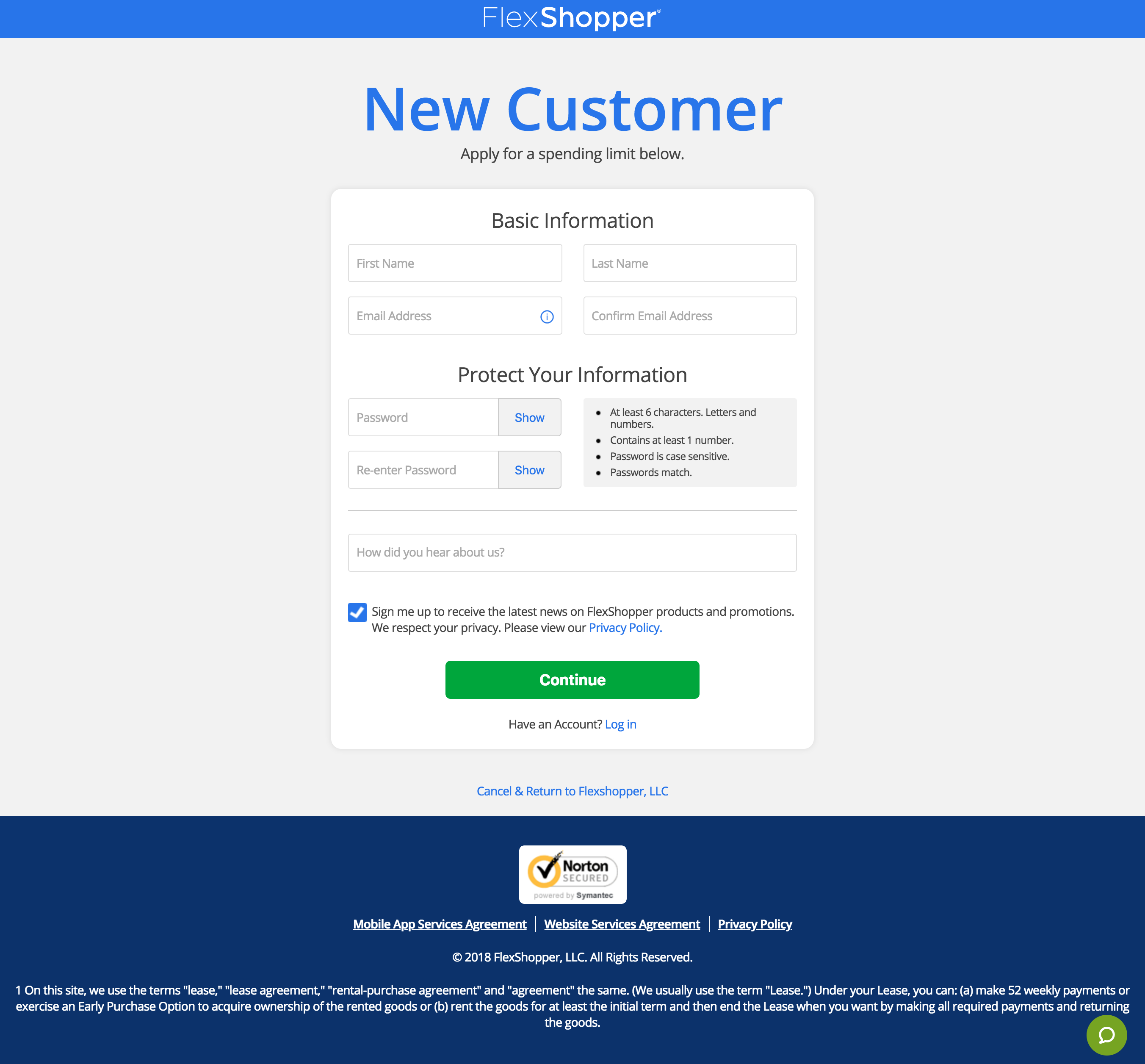

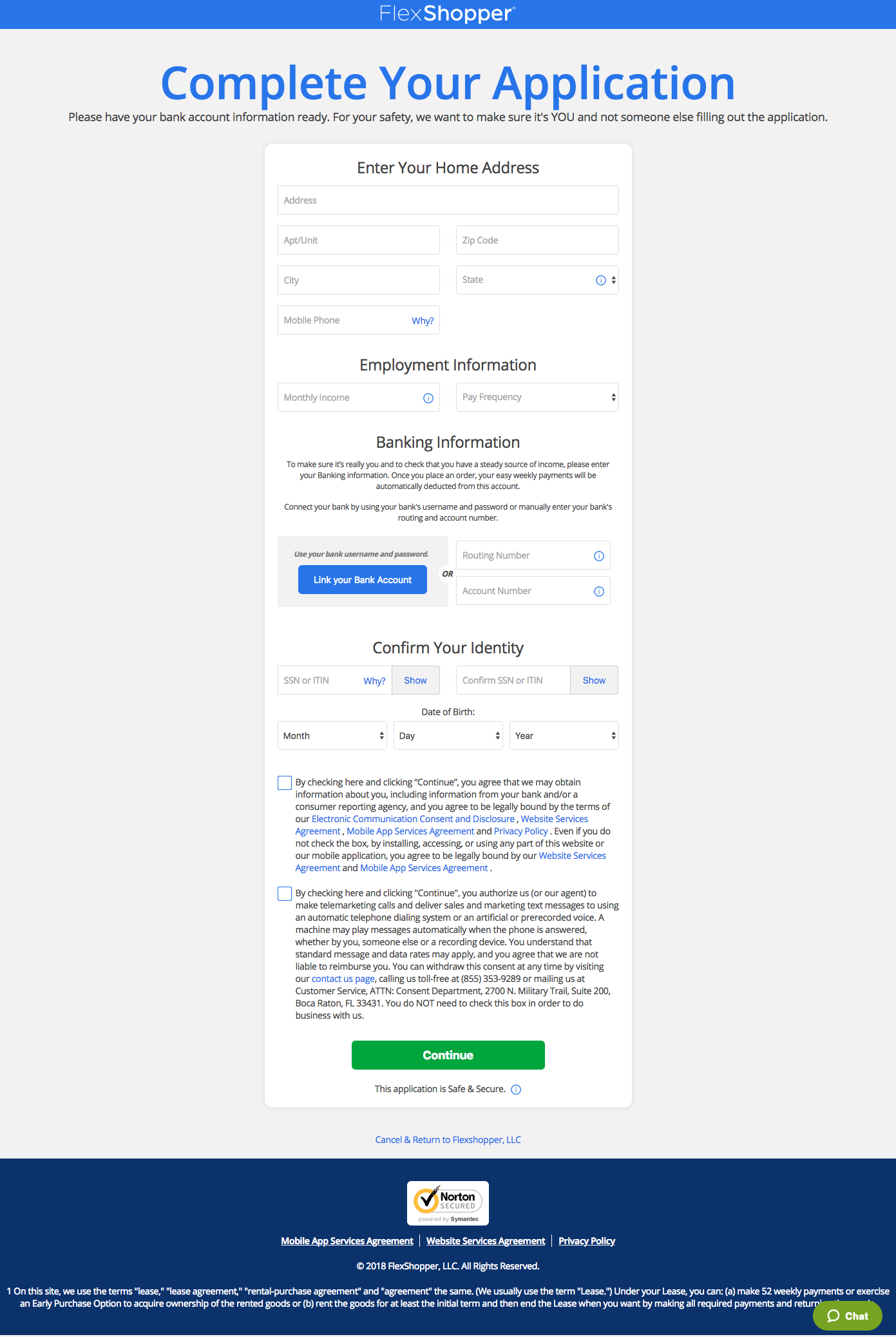

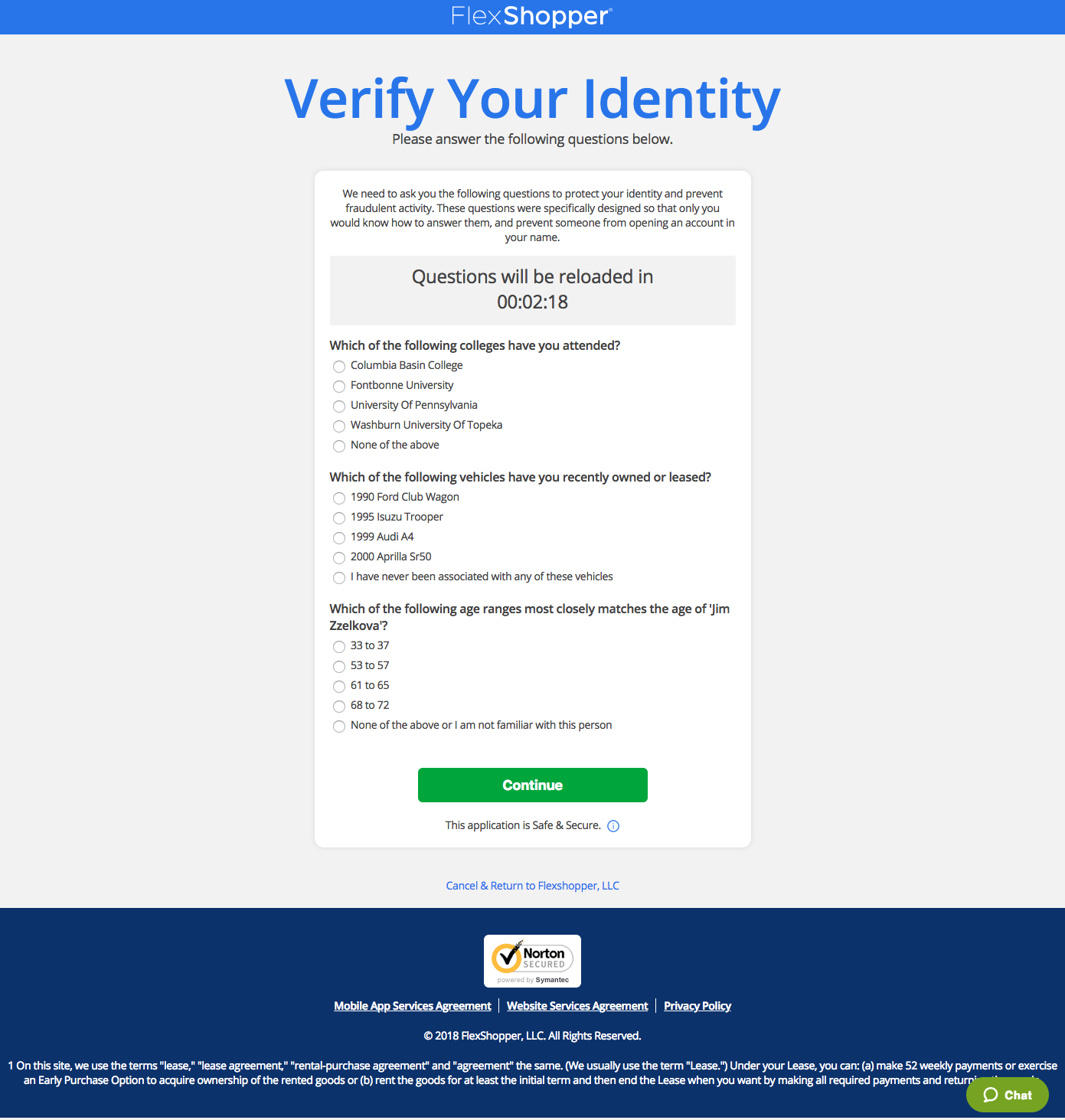

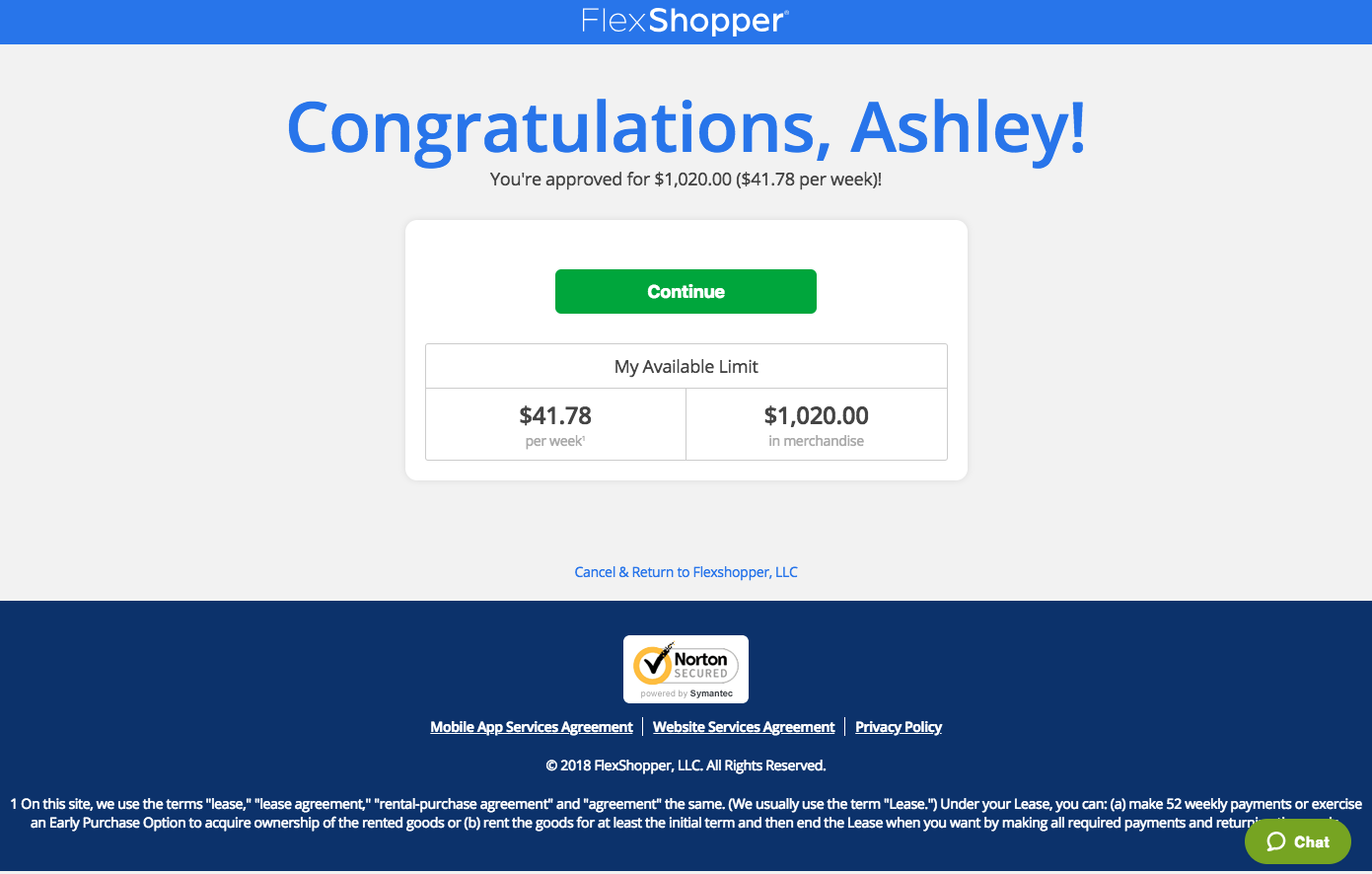

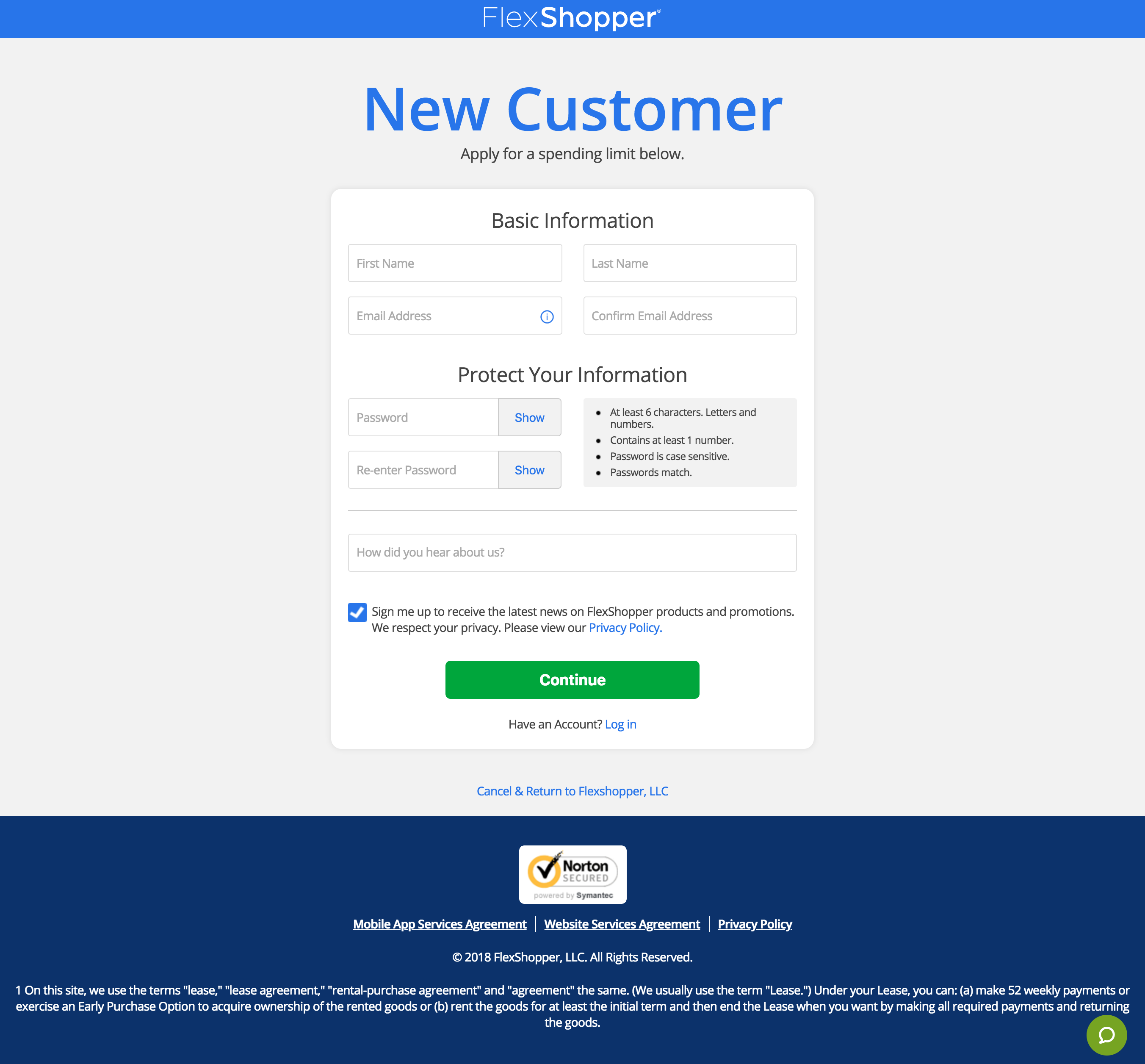

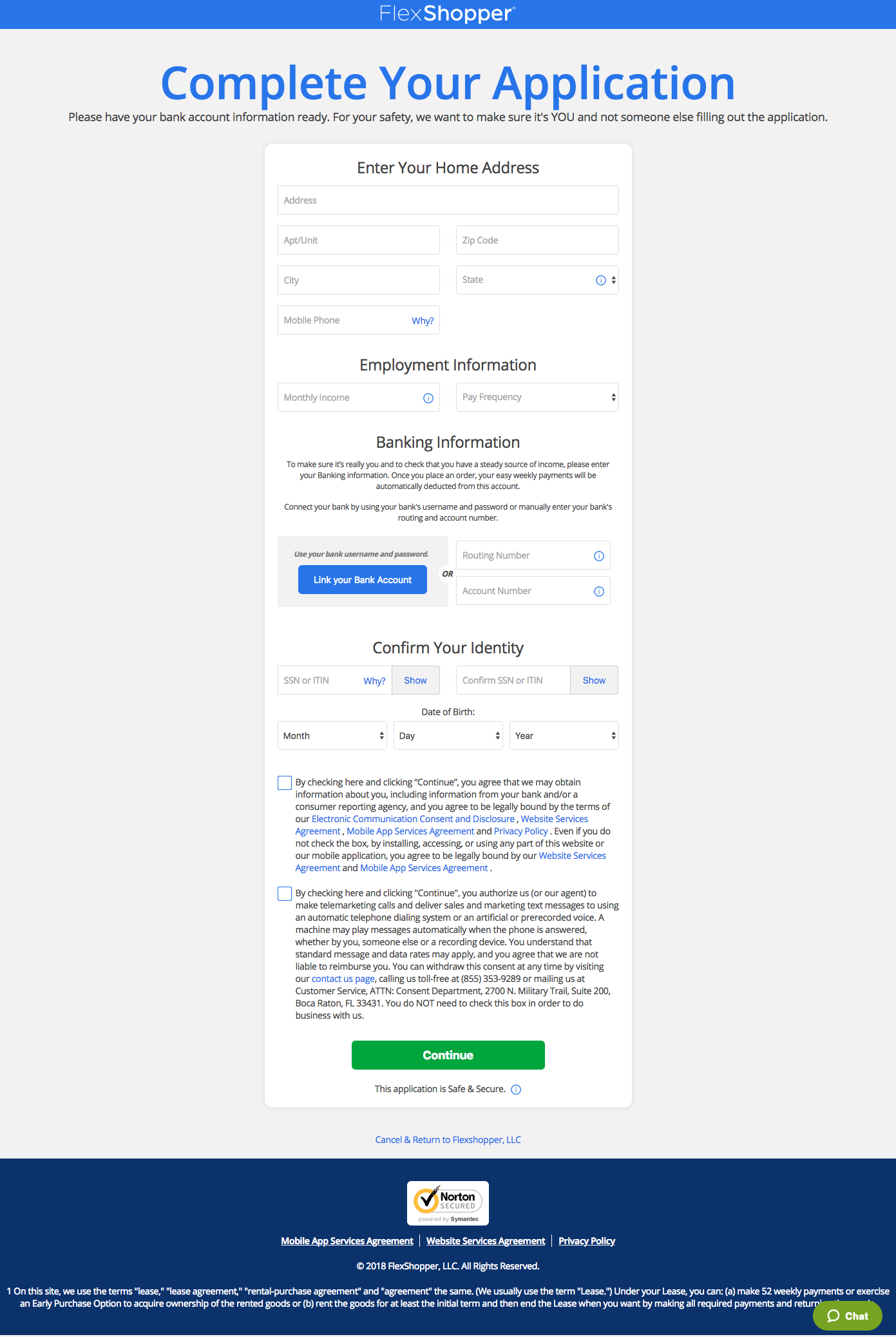

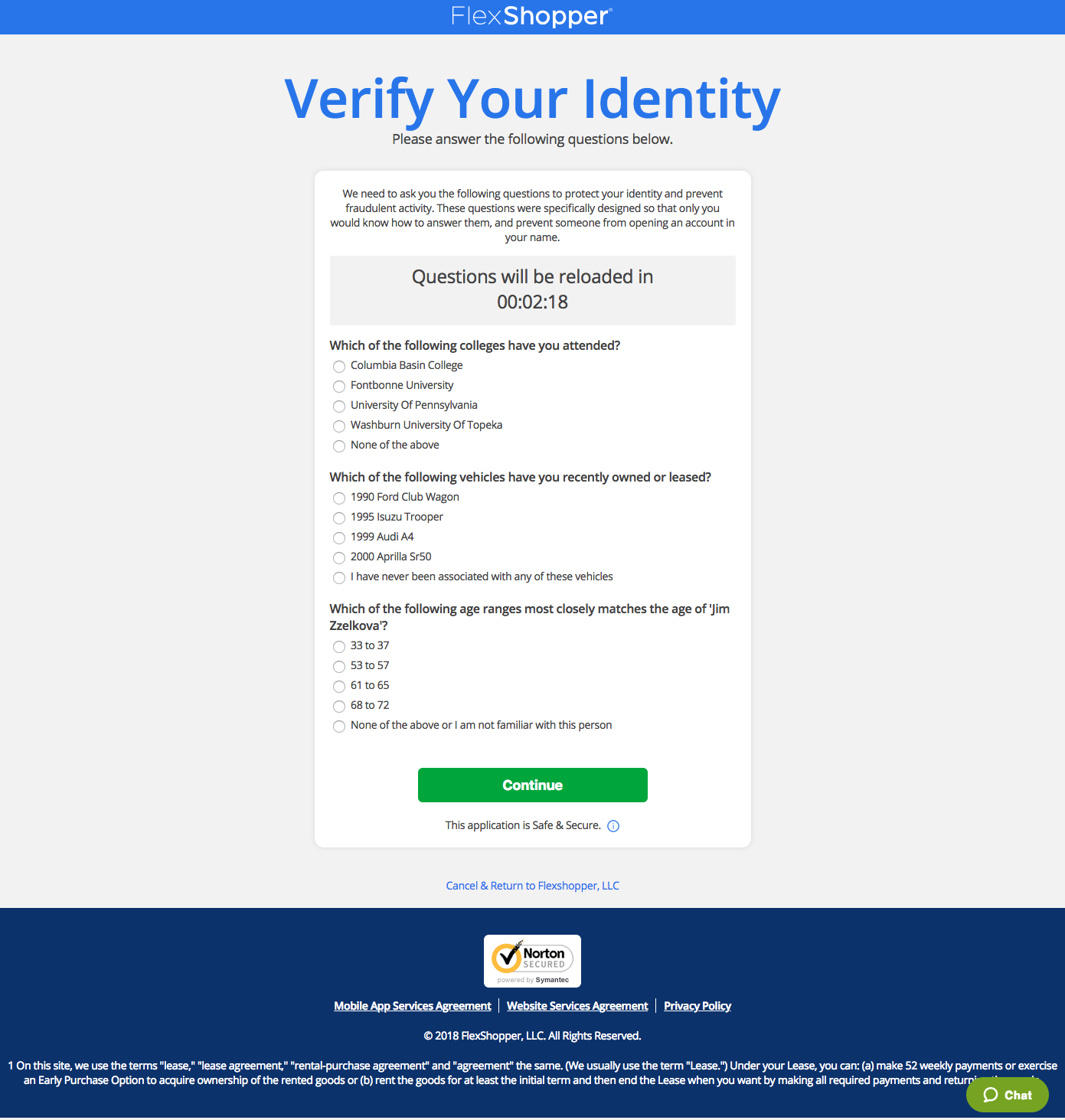

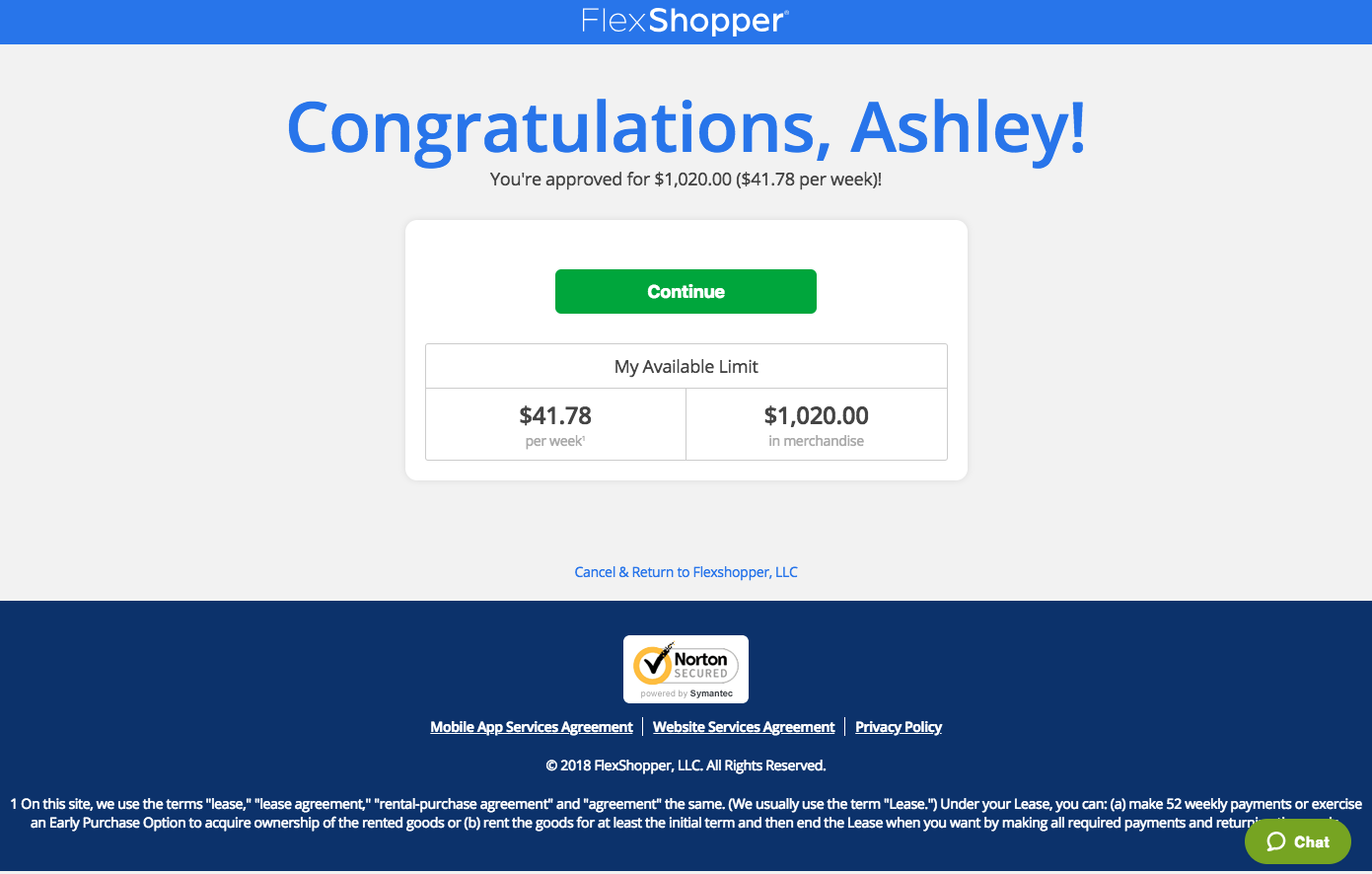

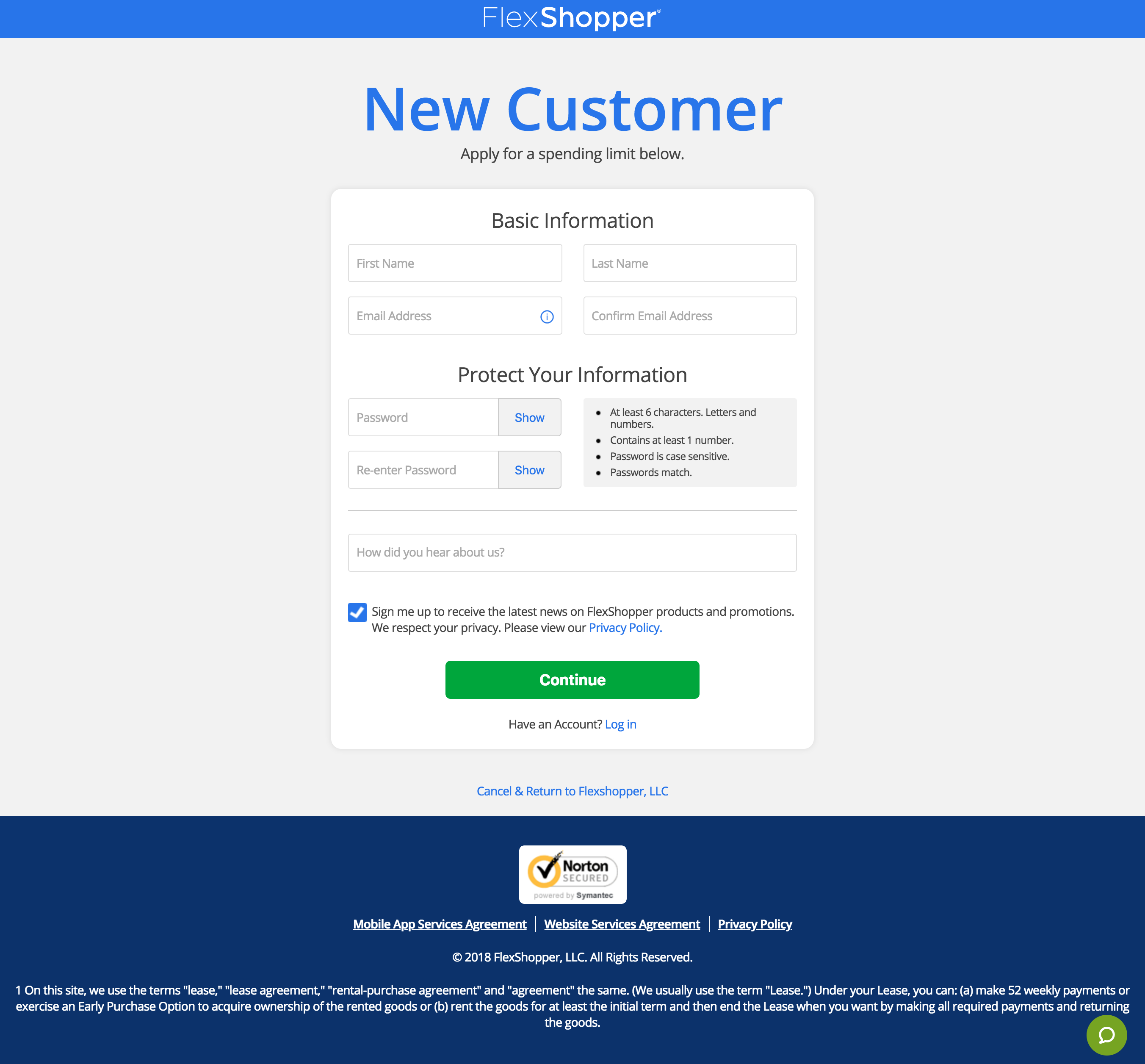

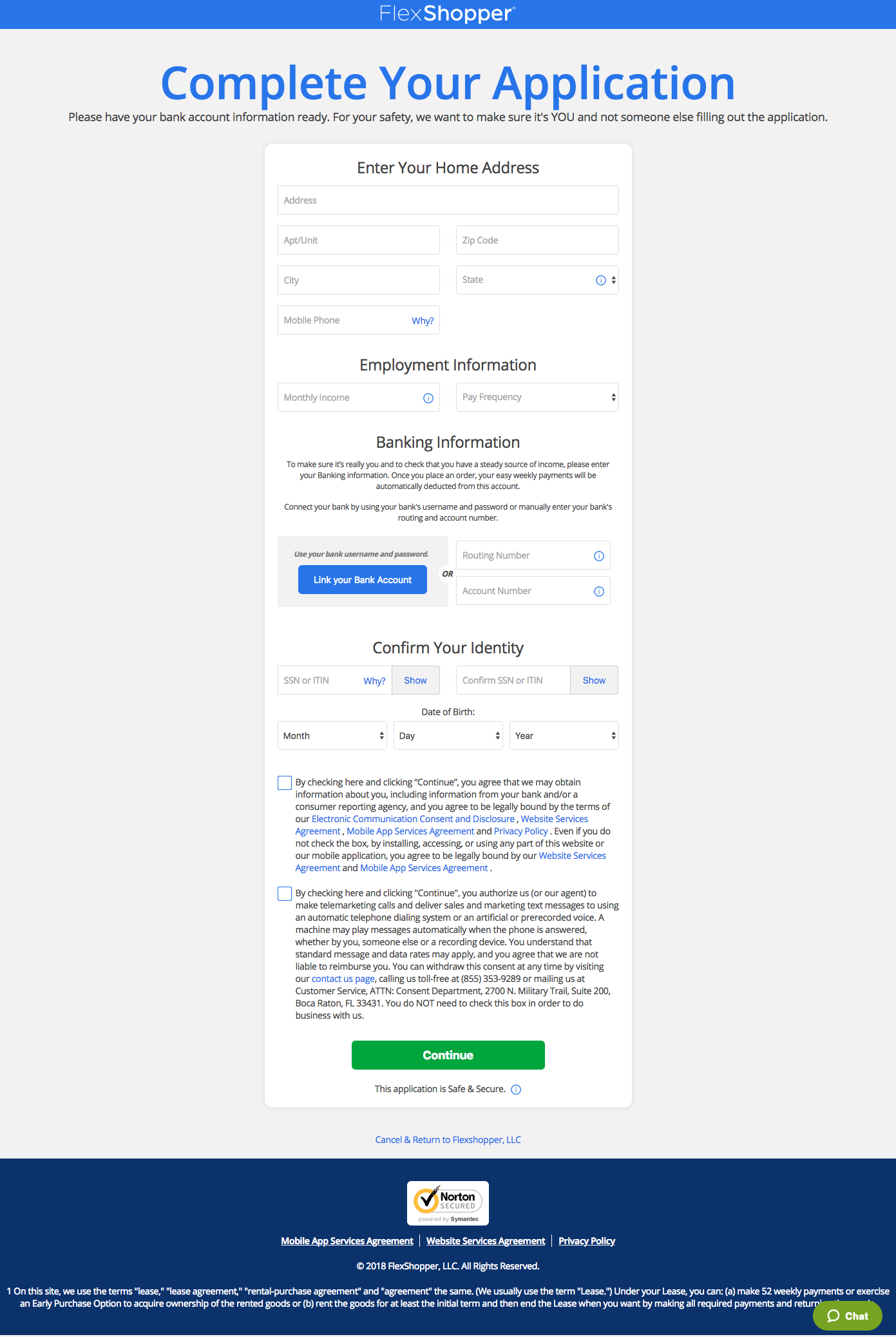

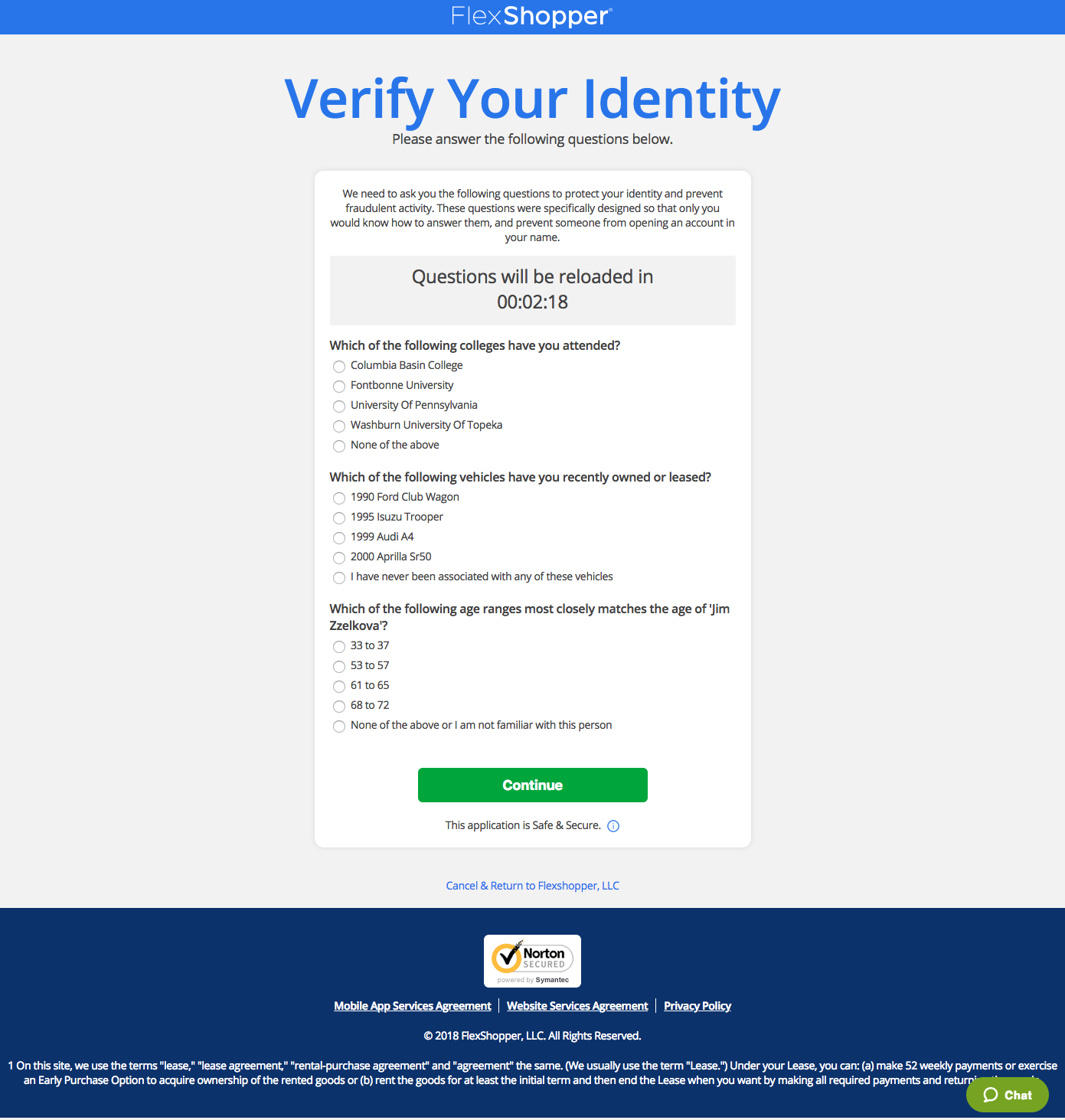

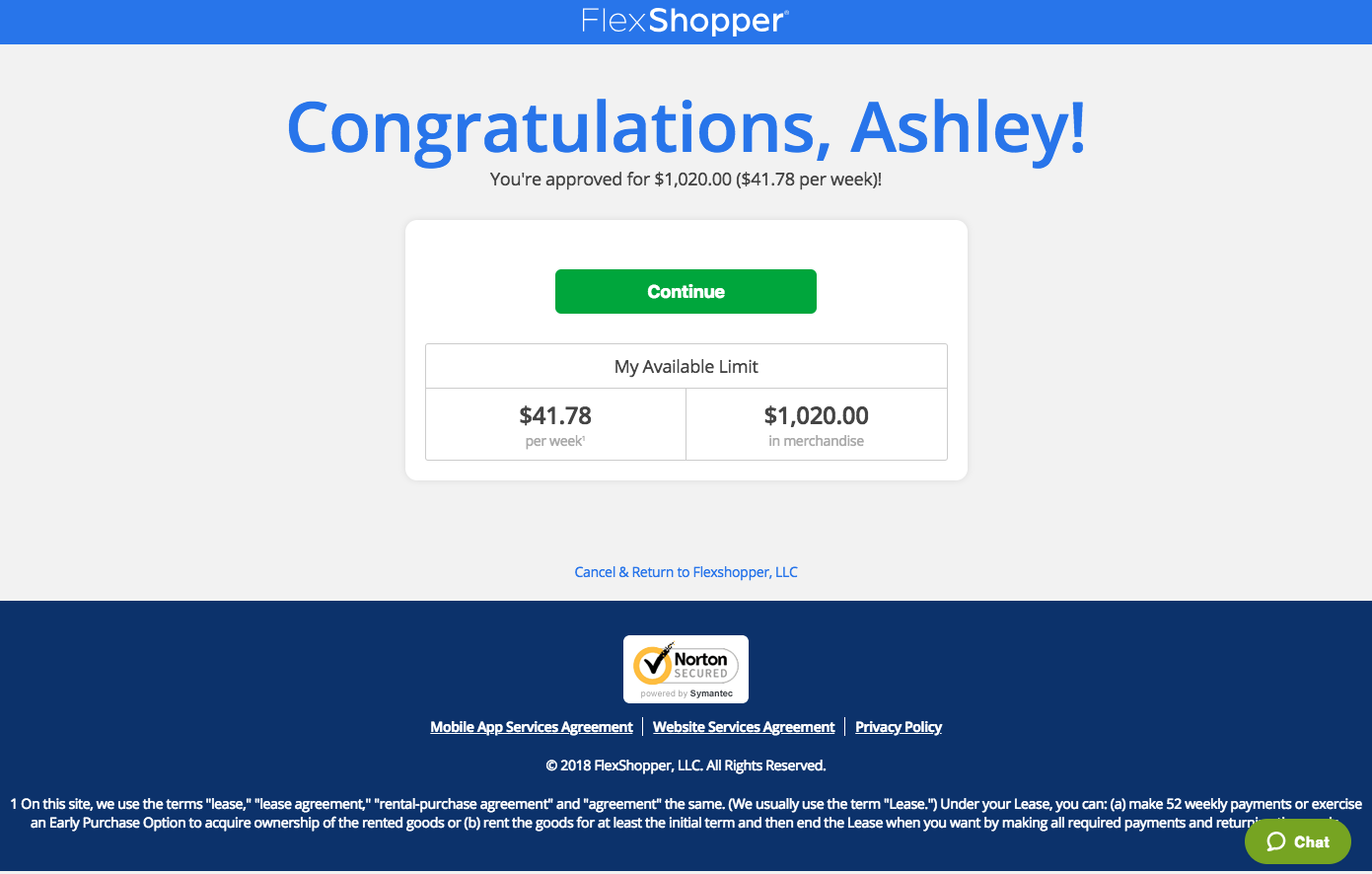

Initial Product

The first version of the application process was not very mobile friendly and had serious issues with form fatigue. Users had little to no incentive to complete the application because it was also not a prerequisite to shop (like the competitor sites at the time). The conversion rate was hard to predict due to lack of data points and events, manual reviews showed a drop when PII or Banking was mentioned.

Project Overview

FlexShopper’s application process is a core entry point for new customers seeking lease-to-own purchasing options for electronics, appliances, furniture, and other high-value items. The current flow offers essential functionality but presents opportunities to reduce friction, improve clarity around requirements, and increase completed applications. This project aims to research, redesign, and optimize the end-to-end application experience to be intuitive, transparent, and conversion-driven while maintaining compliance with financial and leasing regulations.

Project Goals

Increase Application Completion Rate

Streamline steps, reduce cognitive load, and provide contextual guidance to minimize user drop-off, particularly during identity verification, income validation, and payment setup.

Improve Clarity and Trust

Clearly communicate requirements, approval criteria, and what users can expect before, during, and after the application. Establish a tone that is trustworthy, supportive, and transparent.

Reduce Customer Service Dependence

Redesign content, microcopy, progress indicators, and help components to anticipate questions and minimize the need for support calls or chats during the application.

Create a Consistent, Mobile-Optimized Experience

Since a significant portion of FlexShopper applicants use mobile devices, ensure the design is responsive, fast-loading, and optimized for small screens without losing functional clarity.

Support Operational & Compliance Needs

Ensure the redesigned flow remains compliant with lending/lease-to-own guidelines, identity verification standards, and required disclosures, while improving usability and comprehension.

Personas

The Budget-Conscious Parent

Name: Maria Thompson

Age: 34

Occupation: Retail Supervisor

Household Income: ~$45,000/year

Family: Single mother of two (ages 6 and 10)

Tech Comfort: Moderate (primarily mobile user)

The Credit Rebuilder

Name: James Porter

Age: 28

Occupation: Delivery Driver (Gig + Part-Time)

Household Income: ~$32,000/year

Family: Single

Tech Comfort: High (mobile-first, uses apps constantly)

The Deal-Driven Shopper

Name: Danielle Brooks

Age: 42

Occupation: Customer Service Rep

Household Income: ~$55,000/year

Family: Married, one teenager

Tech Comfort: Medium (switches between laptop and mobile)

Desktop Product

Based on feedback from B2B clients we built our application in a modal that can be launched on any site. We also focused on very easy integration so any site could start offering lease-to-own, our site was just the first test. This modal experience would also be able to adapt to any device size or browser limitations.

Mobile Product

When we started redesigning this product we had 50% of our clients on mobile, the average based on competitor research was 75%. We did a mobile first approach to increase effectiveness on mobile devices. The clients that were coming in via mobile (if they already had an account) were much more likely to sign a new agreement, so this would benefit the business overall.

Results & Impact

74%

Mobile Use Increase

225%

Conversion Increase

60%

Savings in Spend

- Aligns with customer mobile-first behavior

- Reduces friction and increases application completion

- Supports transparency needs that are critical for lease-to-own trust

- Provides an app-like experience without forcing app installation

- Lowers support costs

- Enables rapid product iteration

- Strengthens compliance and data accuracy

Lease to Own Modernized

Redesign the application process

Role: Director of UX

Initial Product

The first version of the application process was not very mobile friendly and had serious issues with form fatigue. Users had little to no incentive to complete the application because it was also not a prerequisite to shop (like the competitor sites at the time). The conversion rate was hard to predict due to lack of data points and events, manual reviews showed a drop when PII or Banking was mentioned.

Project Overview

FlexShopper’s application process is a core entry point for new customers seeking lease-to-own purchasing options for electronics, appliances, furniture, and other high-value items. The current flow offers essential functionality but presents opportunities to reduce friction, improve clarity around requirements, and increase completed applications. This project aims to research, redesign, and optimize the end-to-end application experience to be intuitive, transparent, and conversion-driven while maintaining compliance with financial and leasing regulations.

Project Goals

Increase Application Completion Rate

Streamline steps, reduce cognitive load, and provide contextual guidance to minimize user drop-off, particularly during identity verification, income validation, and payment setup.

Improve Clarity and Trust

Clearly communicate requirements, approval criteria, and what users can expect before, during, and after the application. Establish a tone that is trustworthy, supportive, and transparent.

Reduce Customer Service Dependence

Redesign content, microcopy, progress indicators, and help components to anticipate questions and minimize the need for support calls or chats during the application.

Create a Consistent, Mobile-Optimized Experience

Since a significant portion of FlexShopper applicants use mobile devices, ensure the design is responsive, fast-loading, and optimized for small screens without losing functional clarity.

Support Operational & Compliance Needs

Ensure the redesigned flow remains compliant with lending/lease-to-own guidelines, identity verification standards, and required disclosures, while improving usability and comprehension.

Personas

The Budget-Conscious Parent

Name: Maria Thompson

Age: 34

Occupation: Retail Supervisor

Household Income: ~$45,000/year

Family: Single mother of two (ages 6 and 10)

Tech Comfort: Moderate (primarily mobile user)

Goals & Motivations

- Secure essential home items (e.g., appliances, bedroom furniture, laptops for schoolwork) without high upfront cost

- Find a trustworthy, predictable payment plan

- Complete the application quickly during limited free time

Behavior & Context

- Browses on her phone during work breaks or nighttime

- Often multi-tasking; needs clarity and low cognitive load

- Prefers brands that feel transparent and empathetic

Pain Points

- Confusion around eligibility requirements

- Anxiety about credit checks and hidden fees

- Long forms or unclear verification steps

- Fear of being denied after investing time

UX Needs

- Upfront explanation of requirements

- Transparent pricing and approval expectations

- Simple, progressive disclosure flow

- Reassuring, supportive tone with helpful microcopy

The Credit Rebuilder

Name: James Porter

Age: 28

Occupation: Delivery Driver (Gig + Part-Time)

Household Income: ~$32,000/year

Family: Single

Tech Comfort: High (mobile-first, uses apps constantly)

Goals & Motivations

- Acquire electronics (e.g., gaming console, computer, phone)

- Build or re-establish financial stability and credit habits

- Get quick approval without feeling judged by traditional lenders

Behavior & Context

- Applies late at night; expects fast, seamless mobile experience

- Familiar with digital identity verification

- Reads very little — expects guided UX that anticipates needs

Pain Points

- Friction during identity or income verification

- Confusion about what documents will be needed

- Distrust of complicated financial language

- Drop-off when faced with unclear errors or rejections

UX Needs

- Ultra-smooth mobile flow

- Real-time validation and simple explanation of steps

- Clear reassurance about impact on credit

- Fast, low-friction identity verification

The Deal-Driven Shopper

Name: Danielle Brooks

Age: 42

Occupation: Customer Service Rep

Household Income: ~$55,000/year

Family: Married, one teenager

Tech Comfort: Medium (switches between laptop and mobile)

Goals & Motivations

- Wants the convenience of lease-to-own for big purchases

- Prioritizes promotions, low weekly payments, and approval confidence

- Seeks a financial option that feels flexible and low-risk

Behavior & Context

- Researches online before applying

- Compares multiple retailers or financing options

- Willing to complete a longer application if value is clear

- Uses desktop at home but may continue the application on mobile

Pain Points

- Lack of transparency in total costs

- Not knowing progress or time remaining

- Restarting the process when switching devices

- Misunderstanding of approval terms

UX Needs

- Clear progress indicators and time expectations

- Ability to save and resume across devices

- Transparent financial breakdown (weekly, total, promotional pricing)

- Contextual help for terms and disclosures

Desktop Product

Based on feedback from B2B clients we built our application in a modal that can be launched on any site. We also focused on very easy integration so any site could start offering lease-to-own, our site was just the first test. This modal experience would also be able to adapt to any device size or browser limitations.

Mobile Product

When we started redesigning this product we had 50% of our clients on mobile, the average based on competitor research was 75%. We did a mobile first approach to increase effectiveness on mobile devices. The clients that were coming in via mobile (if they already had an account) were much more likely to sign a new agreement, so this would benefit the business overall.

Results & Impact

74%

Mobile Use Increase

225%

Conversion Increase

60%

Savings in Spend

- Aligns with customer mobile-first behavior

- Reduces friction and increases application completion

- Supports transparency needs that are critical for lease-to-own trust

- Provides an app-like experience without forcing app installation

- Lowers support costs

- Enables rapid product iteration

- Strengthens compliance and data accuracy

Lease to Own Modernized

Redesign the application process

Role: Director of UX

Initial Product

The first version of the application process was not very mobile friendly and had serious issues with form fatigue. Users had little to no incentive to complete the application because it was also not a prerequisite to shop (like the competitor sites at the time). The conversion rate was hard to predict due to lack of data points and events, manual reviews showed a drop when PII or Banking was mentioned.

Project Overview

FlexShopper’s application process is a core entry point for new customers seeking lease-to-own purchasing options for electronics, appliances, furniture, and other high-value items. The current flow offers essential functionality but presents opportunities to reduce friction, improve clarity around requirements, and increase completed applications. This project aims to research, redesign, and optimize the end-to-end application experience to be intuitive, transparent, and conversion-driven while maintaining compliance with financial and leasing regulations.

Project Goals

Increase Application Completion Rate

Streamline steps, reduce cognitive load, and provide contextual guidance to minimize user drop-off, particularly during identity verification, income validation, and payment setup.

Improve Clarity and Trust

Clearly communicate requirements, approval criteria, and what users can expect before, during, and after the application. Establish a tone that is trustworthy, supportive, and transparent.

Reduce Customer Service Dependence

Redesign content, microcopy, progress indicators, and help components to anticipate questions and minimize the need for support calls or chats during the application.

Create a Consistent, Mobile-Optimized Experience

Since a significant portion of FlexShopper applicants use mobile devices, ensure the design is responsive, fast-loading, and optimized for small screens without losing functional clarity.

Support Operational & Compliance Needs

Ensure the redesigned flow remains compliant with lending/lease-to-own guidelines, identity verification standards, and required disclosures, while improving usability and comprehension.

Personas

Desktop Product

Based on feedback from B2B clients we built our application in a modal that can be launched on any site. We also focused on very easy integration so any site could start offering lease-to-own, our site was just the first test. This modal experience would also be able to adapt to any device size or browser limitations.

Mobile Product

When we started redesigning this product we had 50% of our clients on mobile, the average based on competitor research was 75%. We did a mobile first approach to increase effectiveness on mobile devices. The clients that were coming in via mobile (if they already had an account) were much more likely to sign a new agreement, so this would benefit the business overall.

Results & Impact

74%

Mobile Use Increase

225%

Conversion Increase

60%

Savings in Spend

- Aligns with customer mobile-first behavior

- Reduces friction and increases application completion

- Supports transparency needs that are critical for lease-to-own trust

- Provides an app-like experience without forcing app installation

- Lowers support costs

- Enables rapid product iteration

- Strengthens compliance and data accuracy