Macro-Investing Made Human

UX Revamp of the Allio Capital Experience

Role: Director of UX

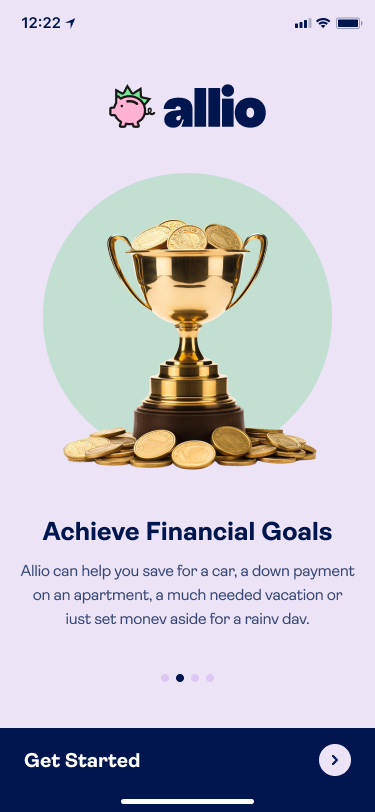

Initial Product

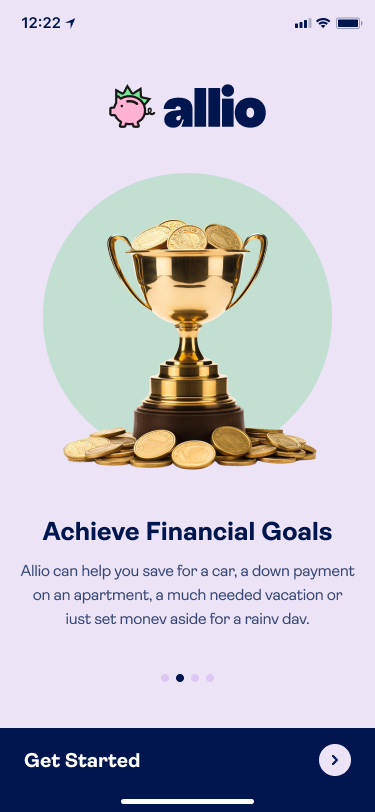

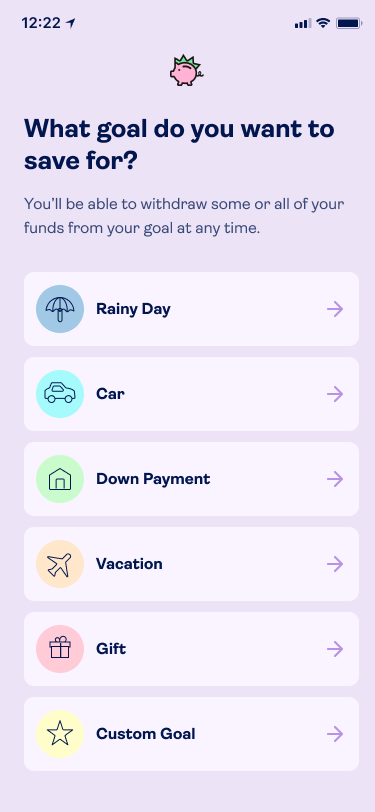

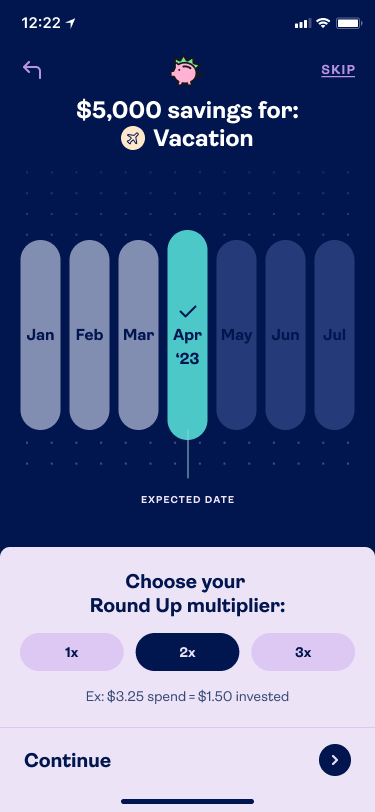

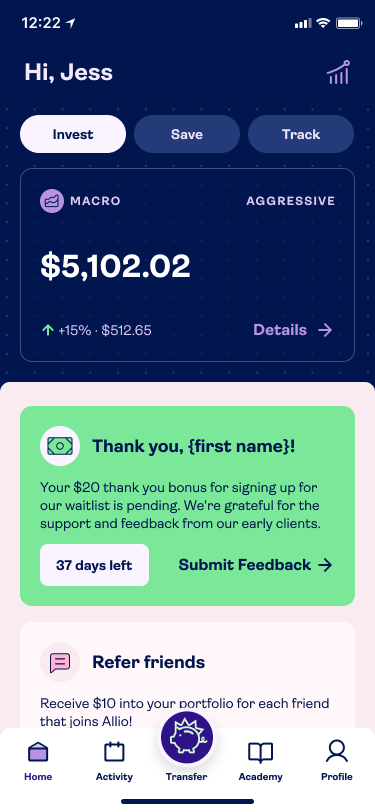

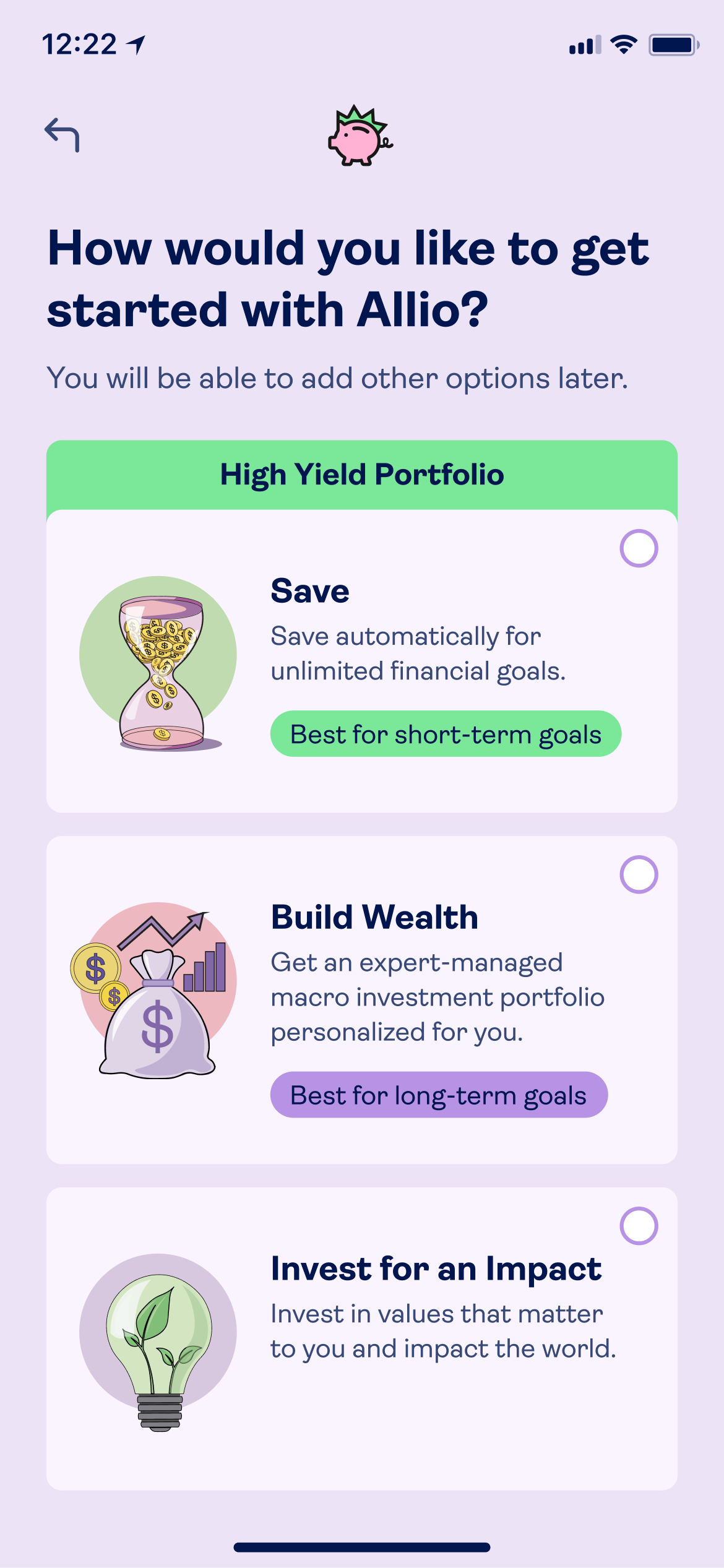

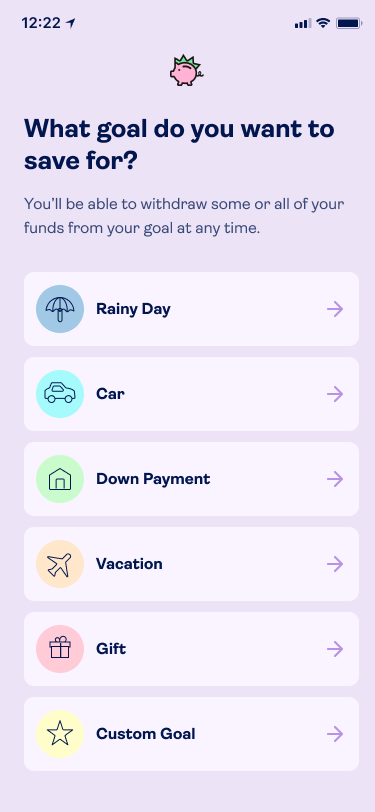

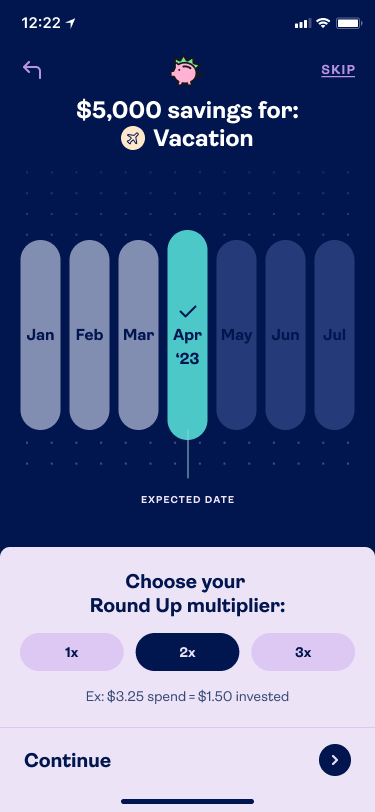

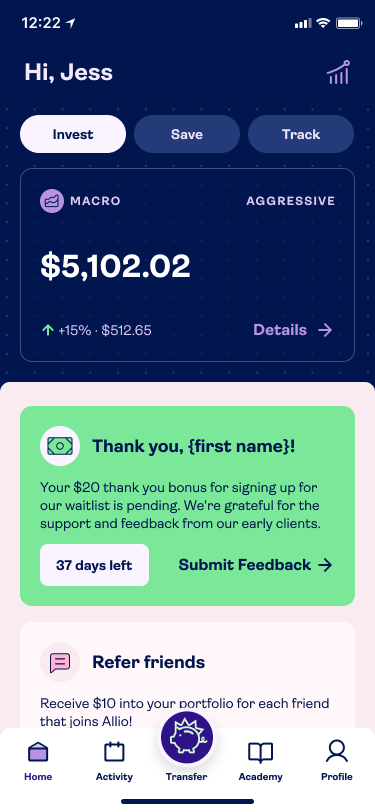

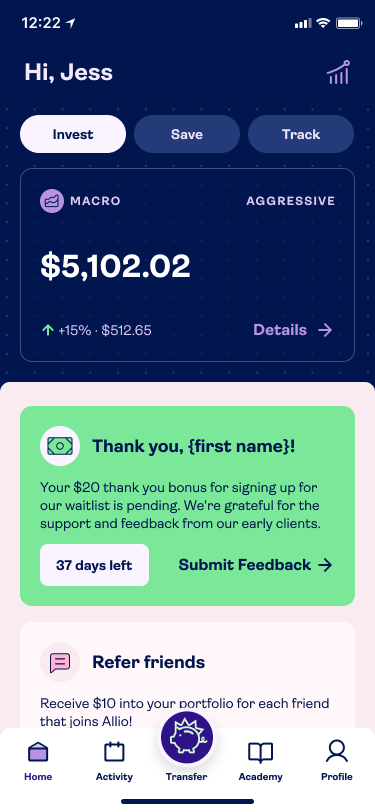

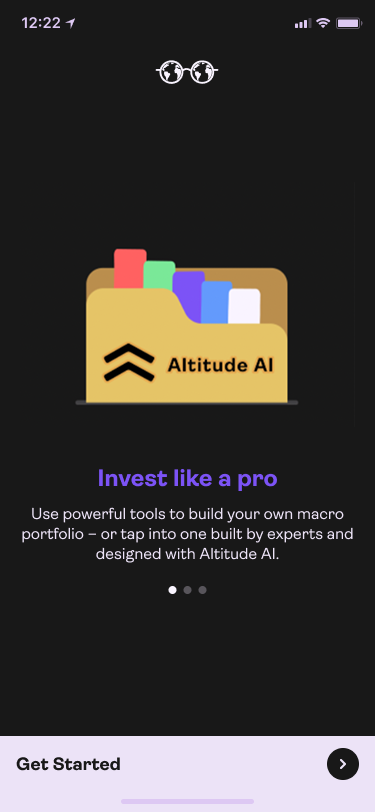

The initial product we released was for a younger audience, specifically the Gen-Z market. The product was created similar to other savings applications, but with better strategies. The objective of the original product was to help clients achieve financial goals while also investing in strategies that they believe in. All the strategies were managed and powered by our internal AI investment engine.

Project Overview

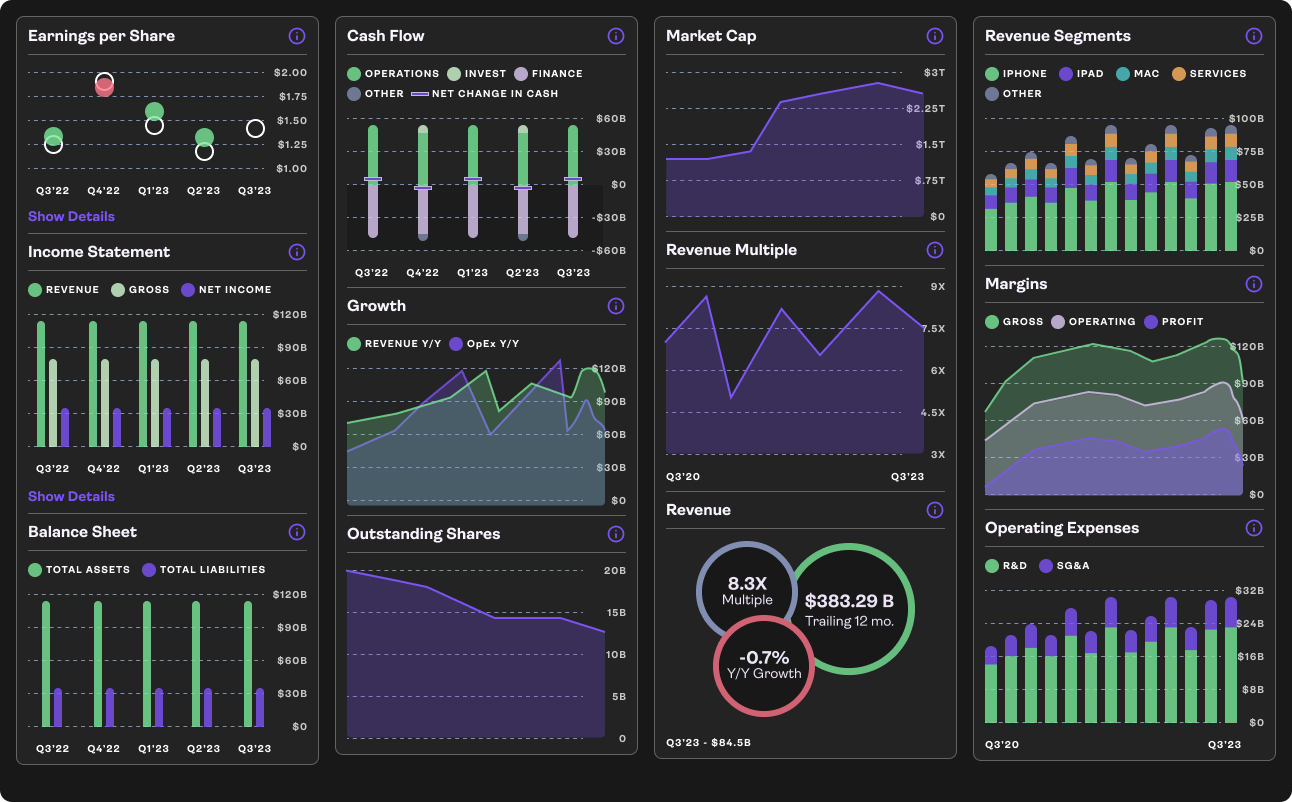

Allio Capital offers a unique value proposition: AI-powered macro investing, combining economic insight with portfolio strategy, via features such as the managed macro portfolio, dynamic macro portfolio, net-worth tracker and macro dashboard. We want to elevate the user experience across mobile and web to better serve both investor-savvy users and those newer to macro strategies; making high complexity feel intuitive and empowering.

Objectives & Success Metrics

Primary Goals

- Simplify onboarding and accelerate “first portfolio set-up” time (reduce friction).

- Increase user engagement with the macro dashboard & portfolio builder (deeper use of features).

- Improve trust and clarity in AI-driven decisions (transparency in ALTITUDE AI™ insights).

- Enhance retention and initial deposit metrics (e.g., first 30 days, month-to-month).

Key Metrics

- Drop-off rate during onboarding (–50%).

- Time from sign-up to first investment decision (reduce by 30%).

- Percentage of users who view the macro dashboard at least once per month (15%).

- Net-promoter score (NPS) for app usability and clarity of AI-explanations (+10pts).

- Retention rate at Day 30 and Day 90 (improvement vs current baseline).

Personas

Experienced investor

Comfortable with markets, wants advanced controls of sectors/themes; values data and speed.

Goal-oriented investor

Less focused on individual stocks, more interested in “set-and-forget” macro portfolios; values simplicity, trust, automation.

Macro-curious learner

New to macro investing; wants to understand “why” the portfolio is moving, not just “what”; needs education and clarity.

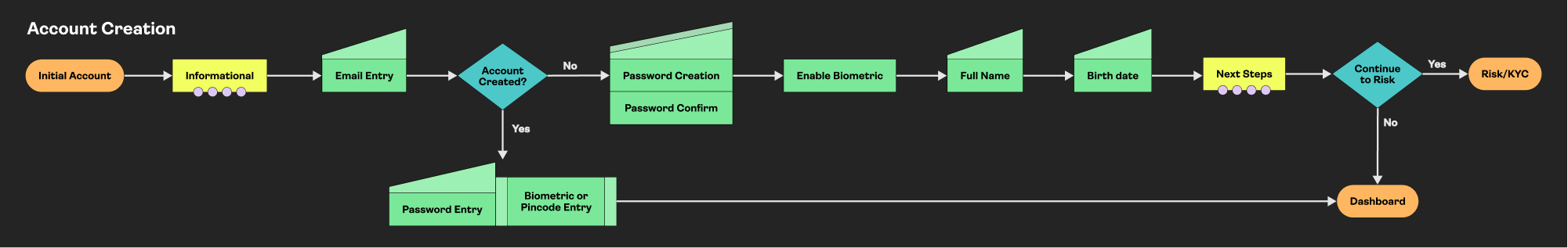

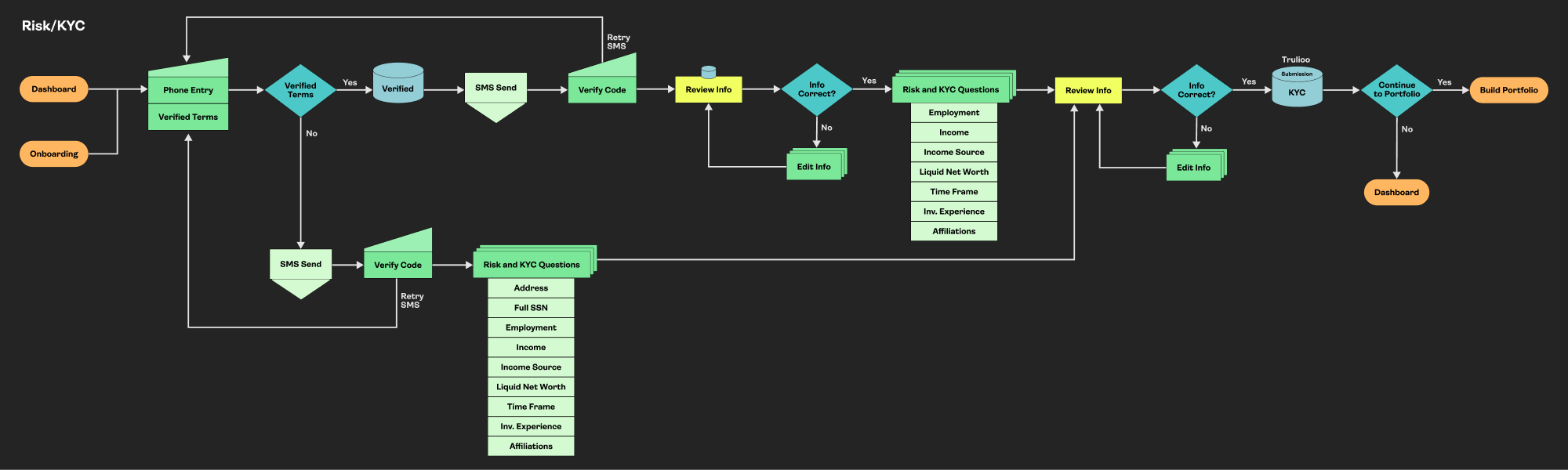

Client Journey

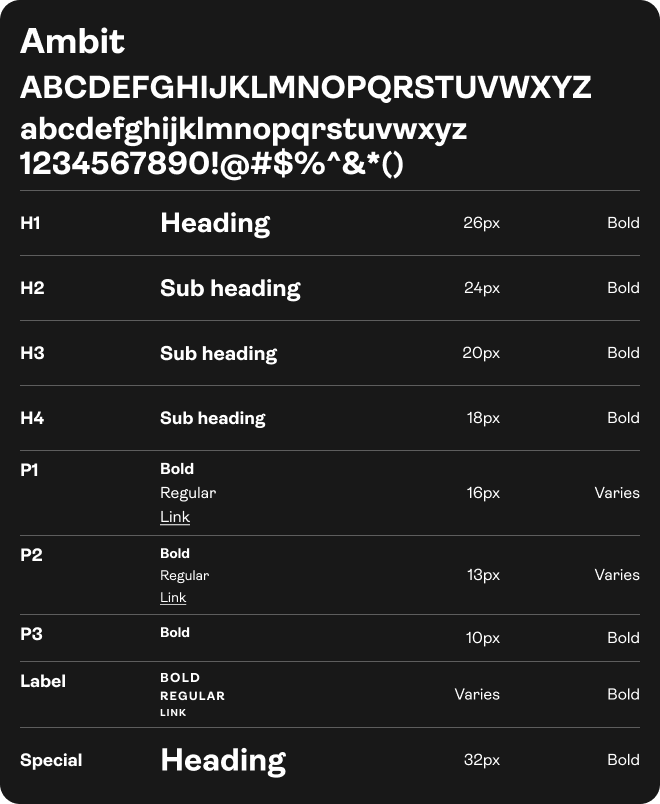

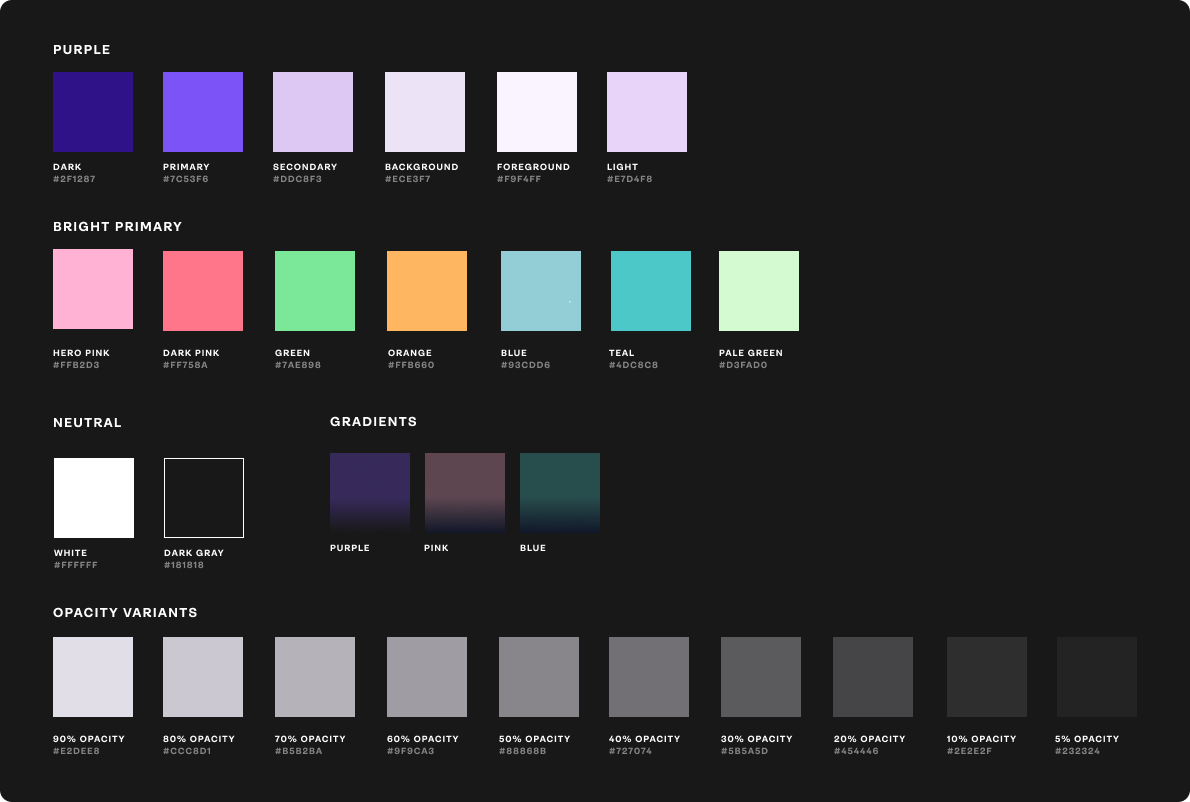

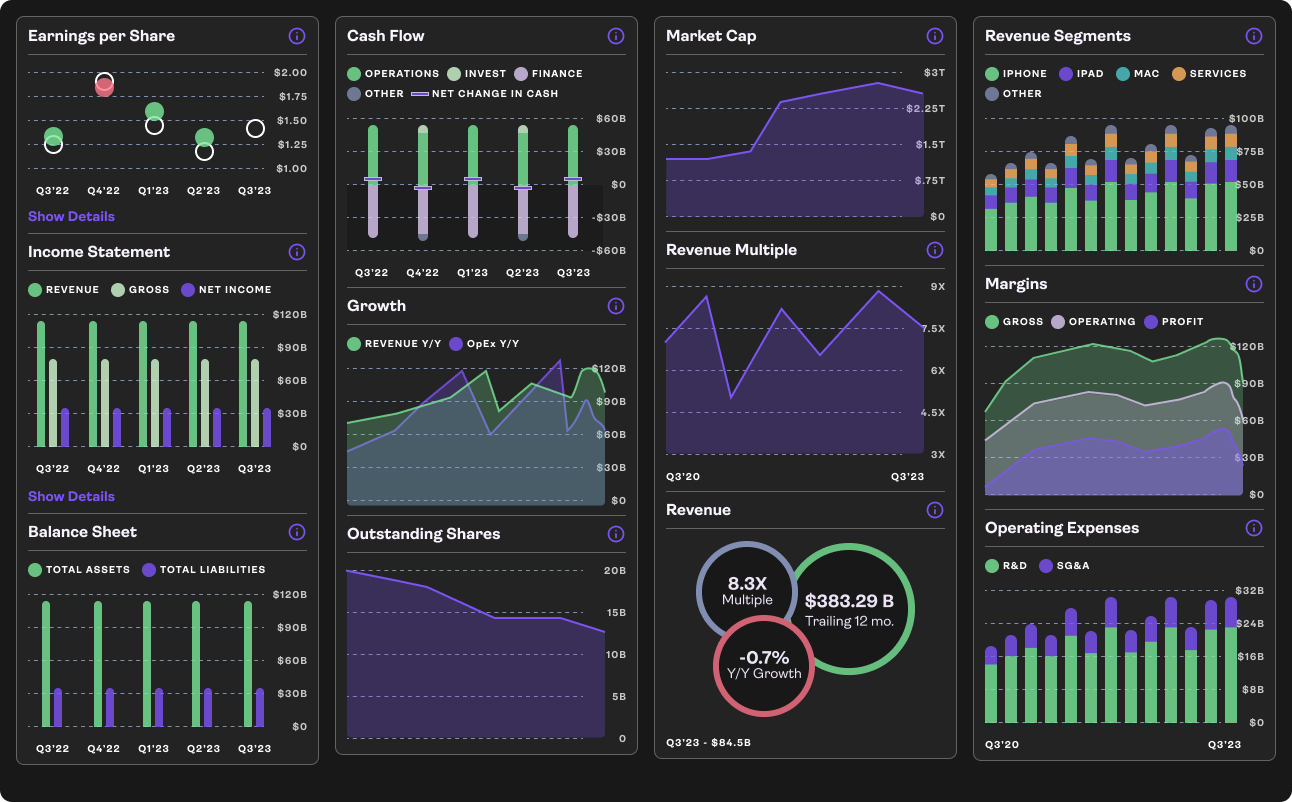

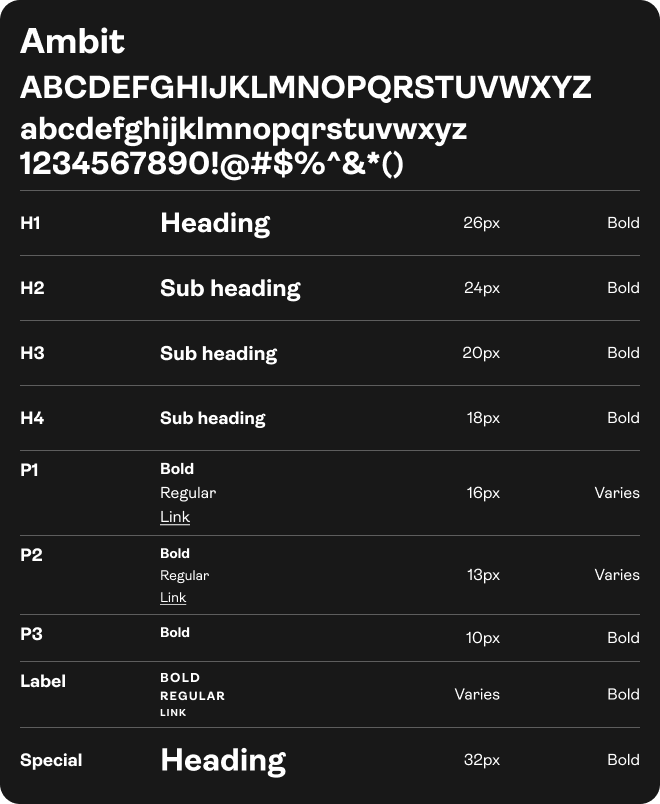

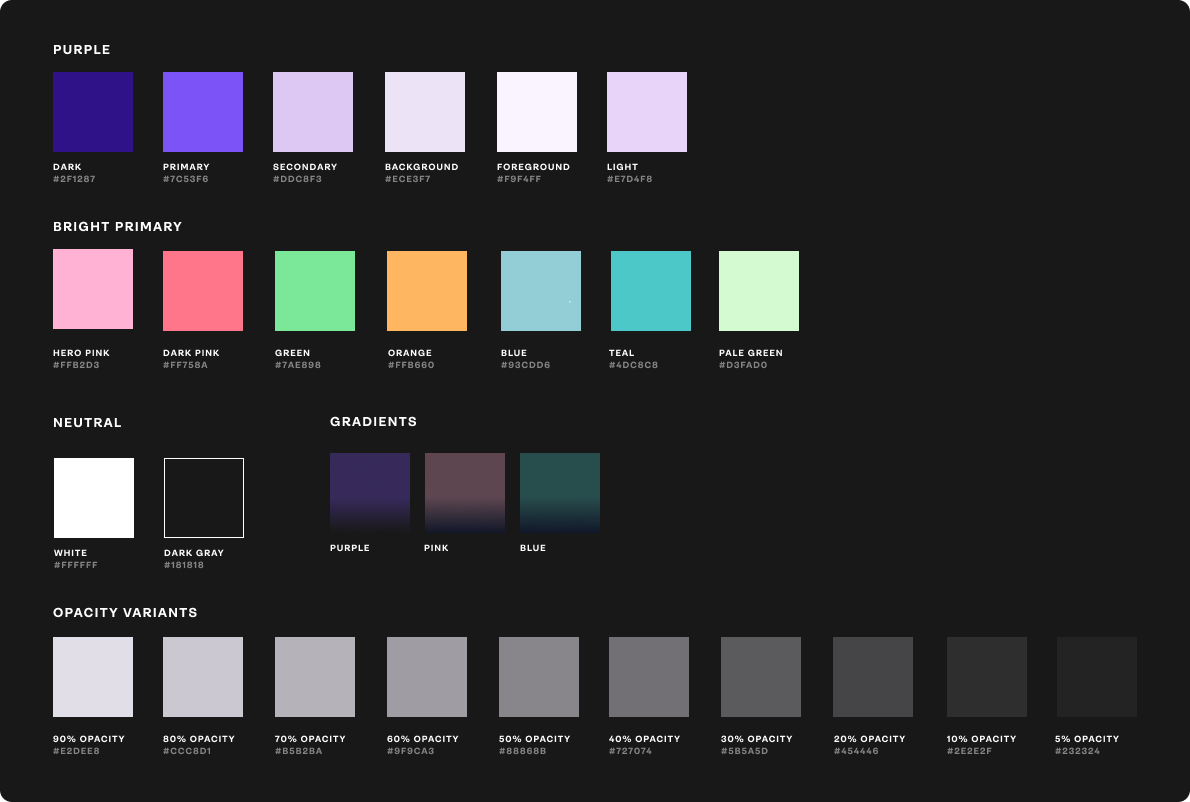

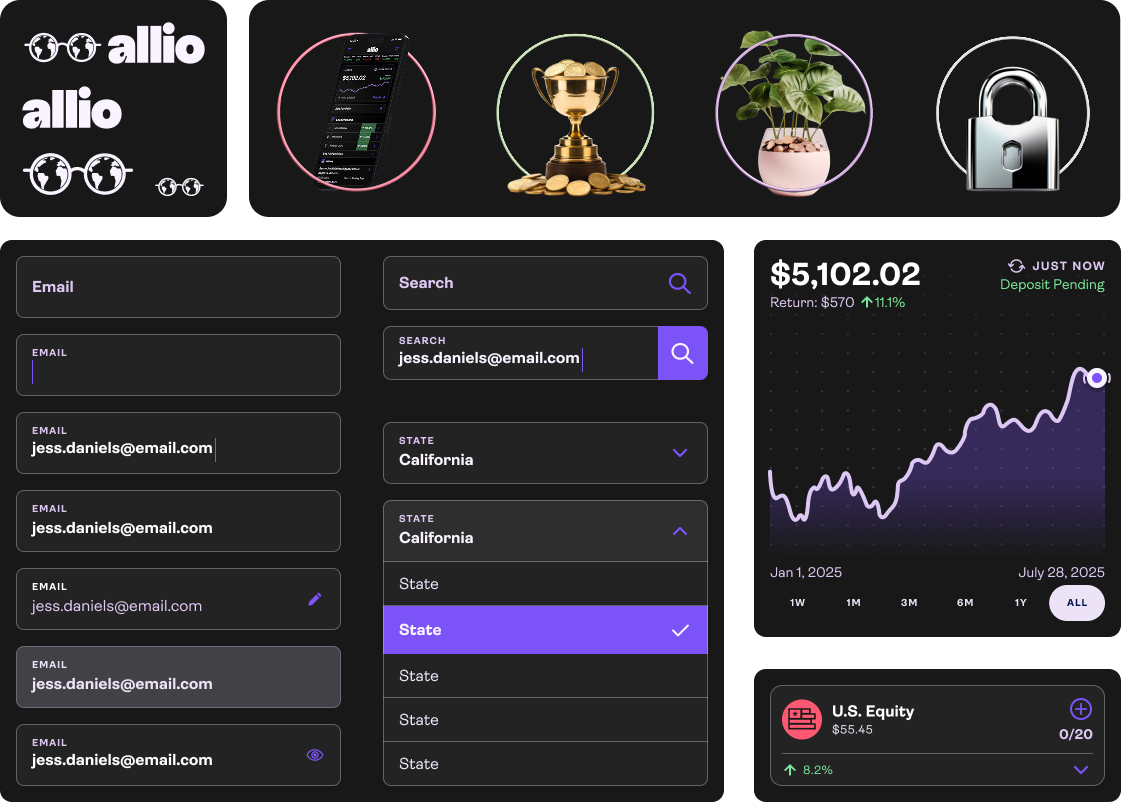

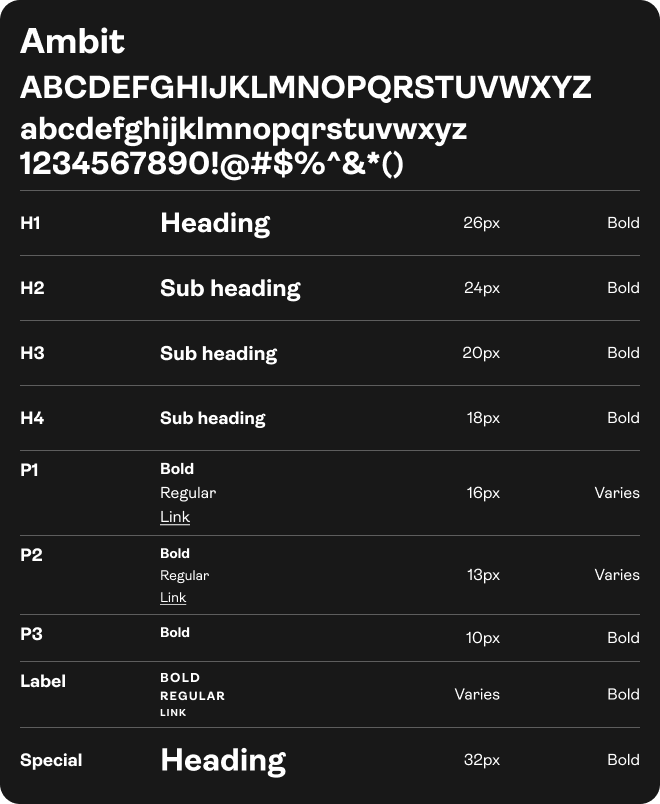

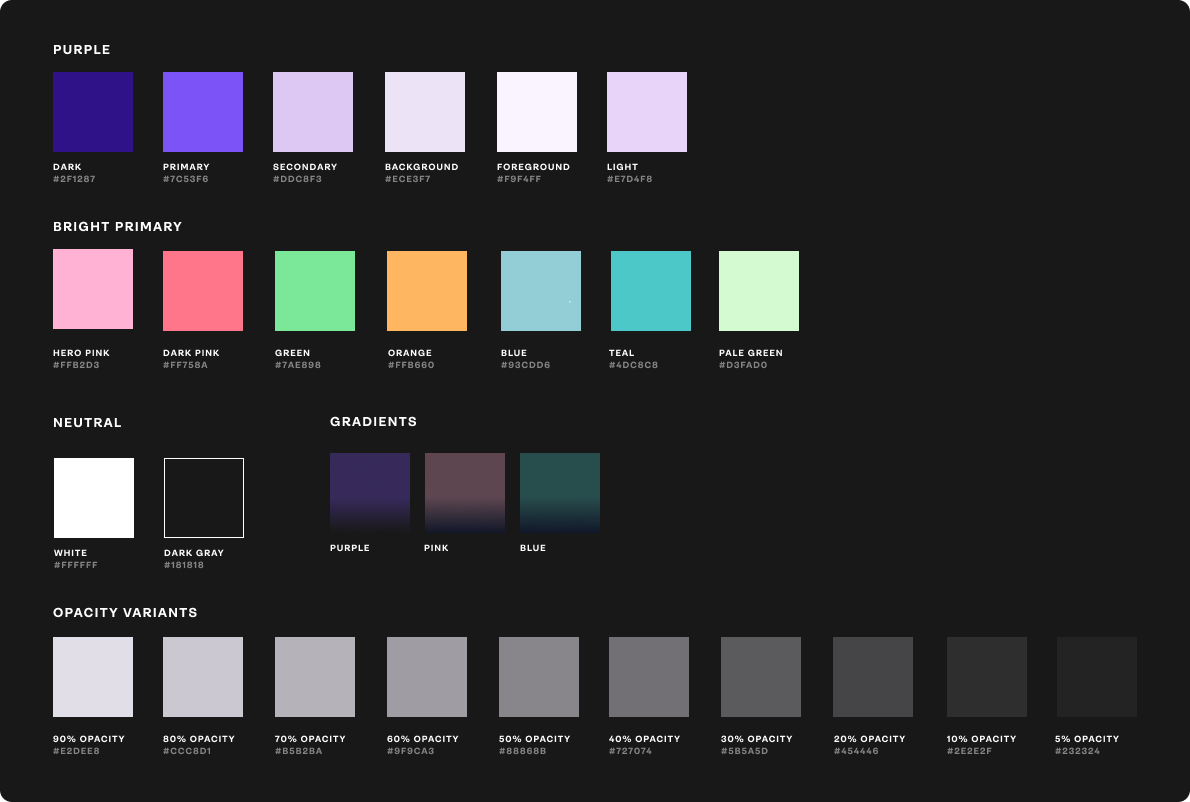

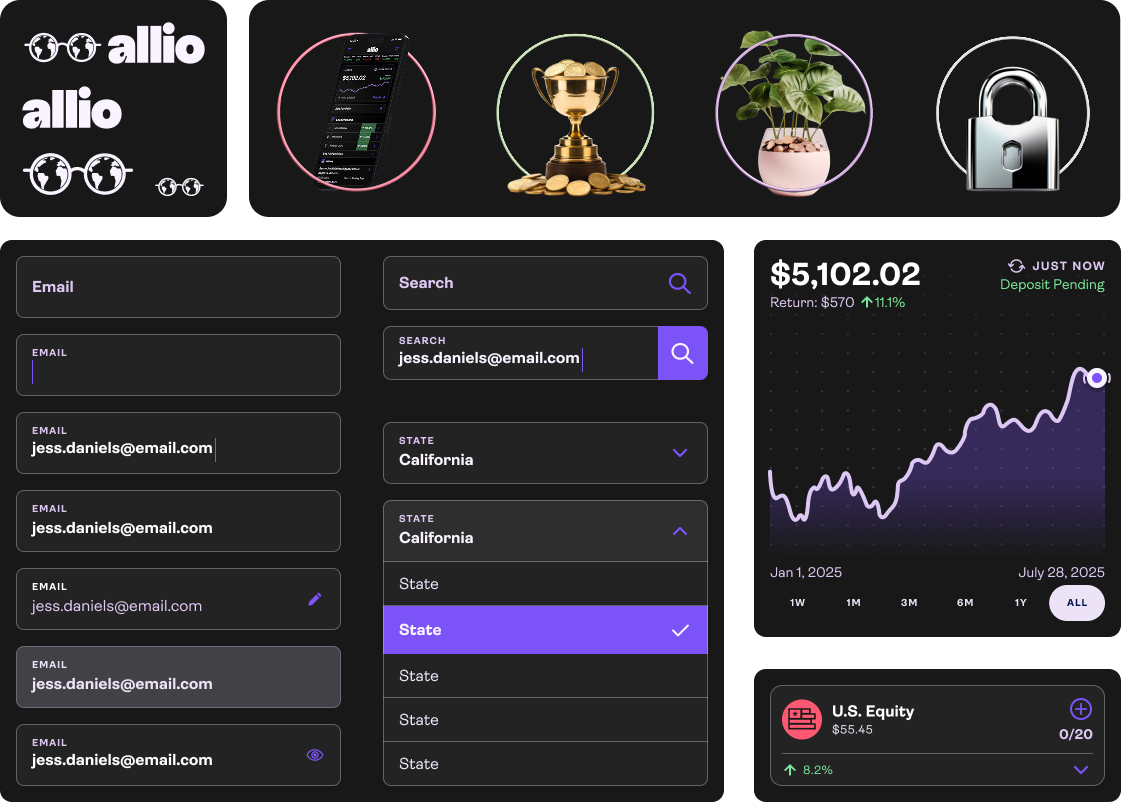

Design System & Components

Lottie Examples

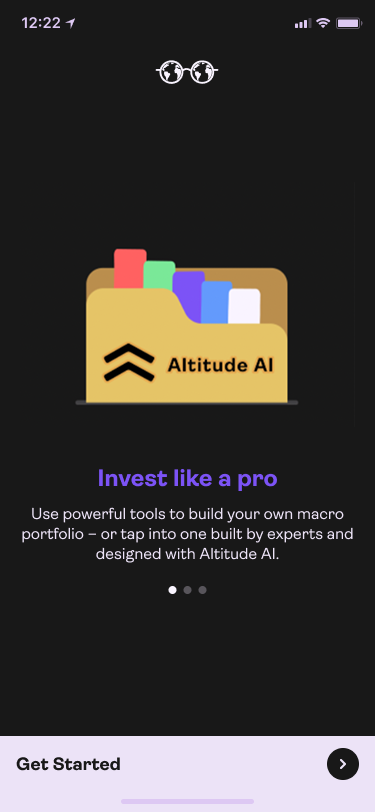

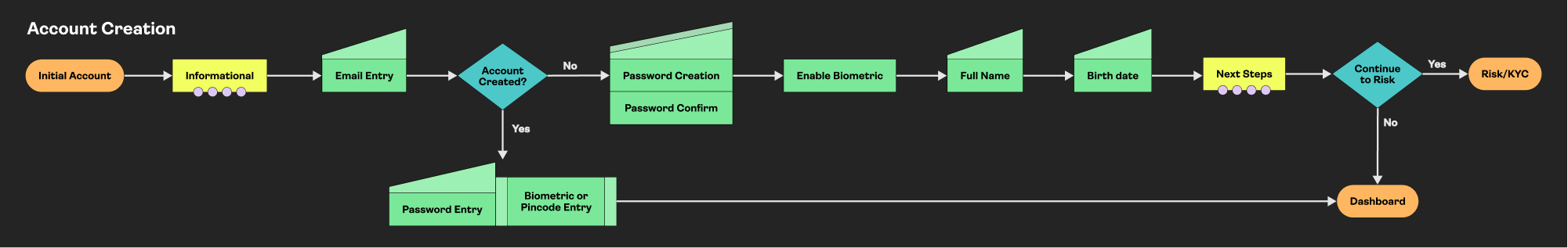

Onboarding

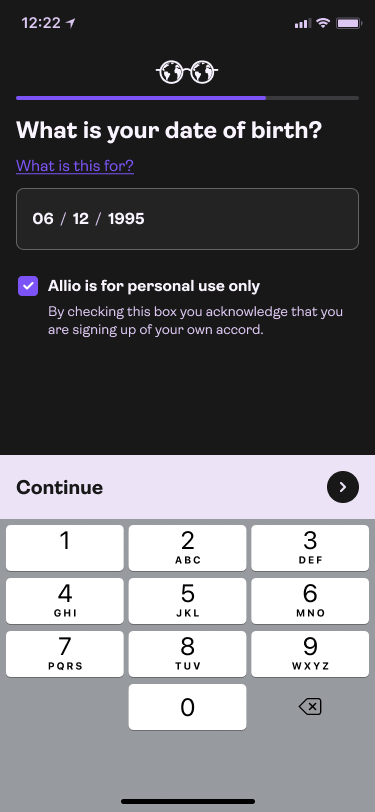

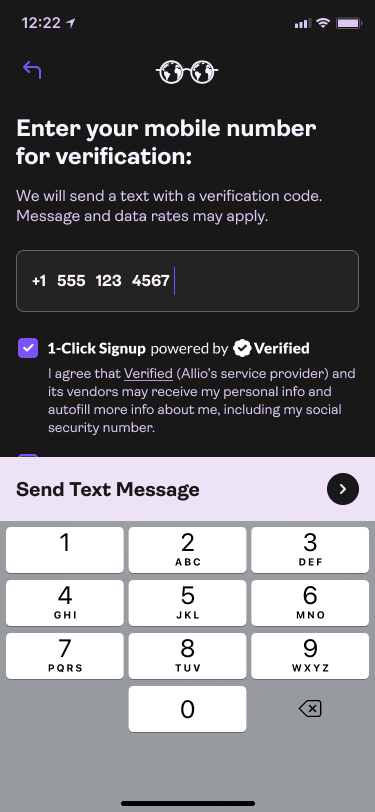

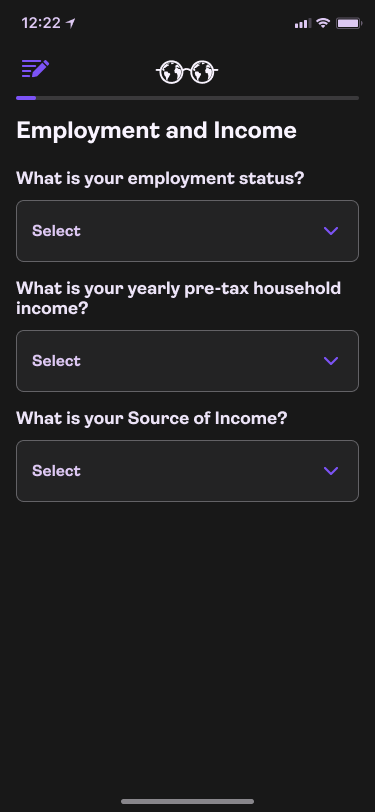

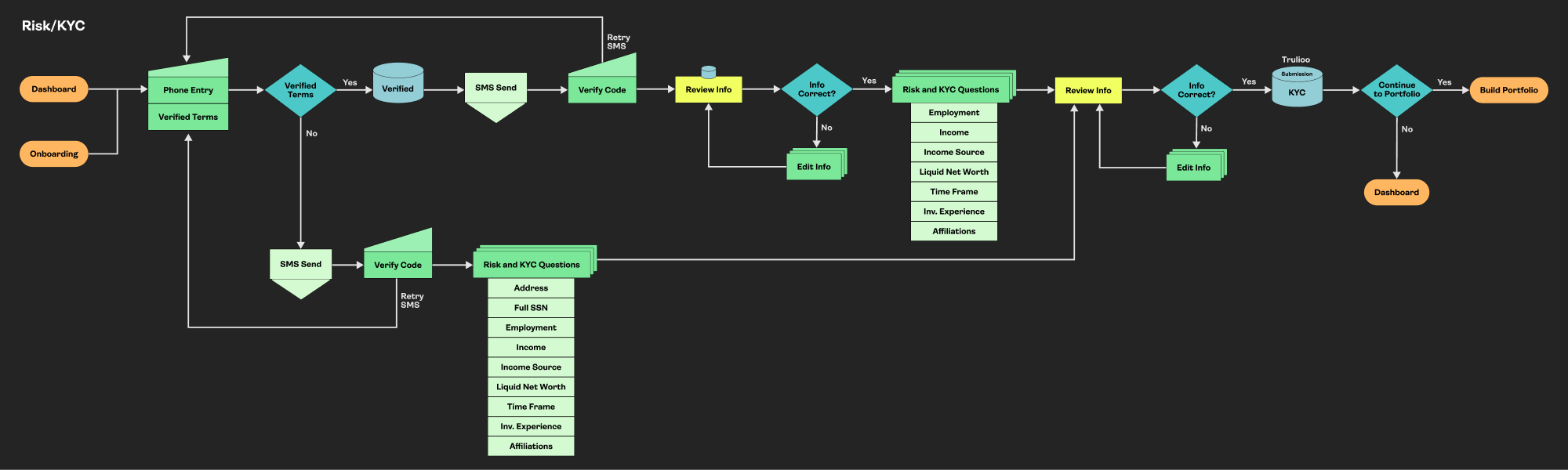

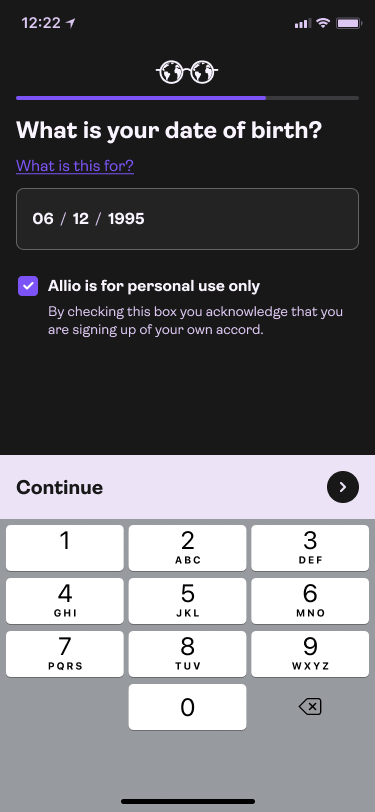

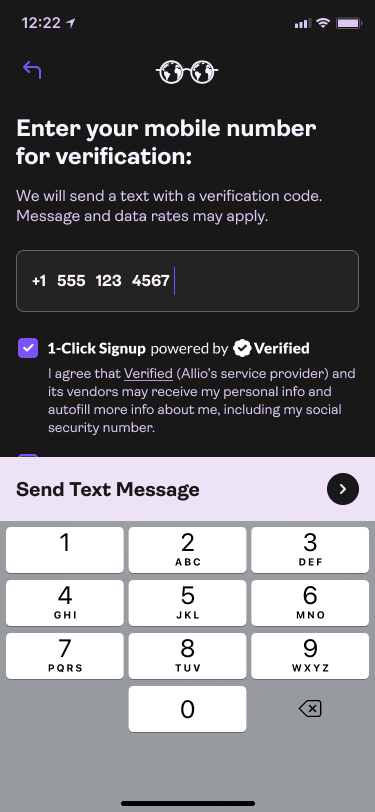

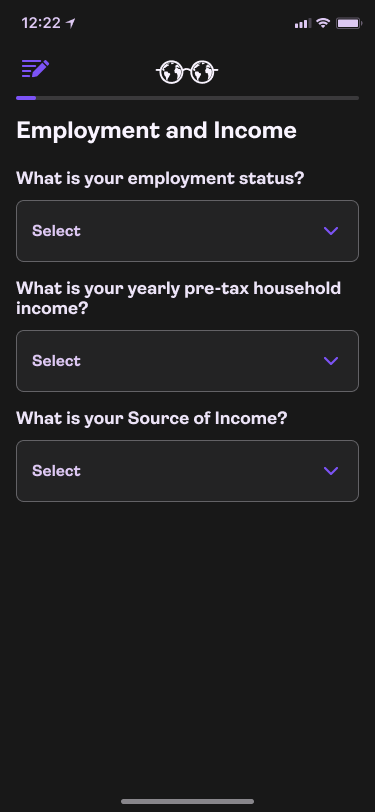

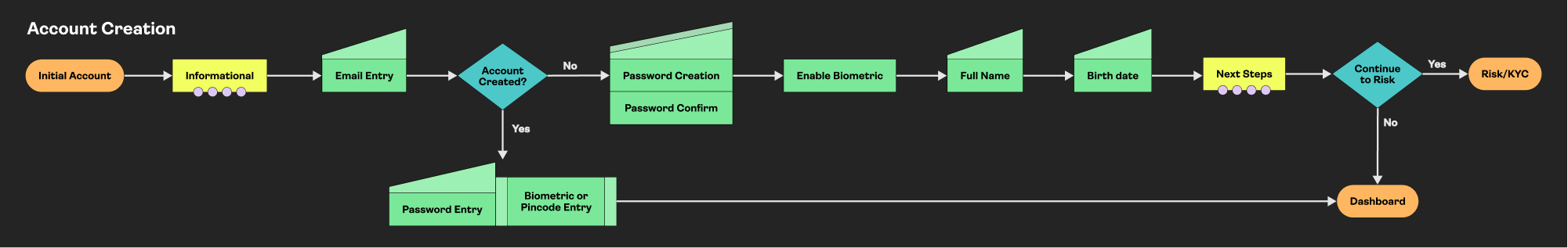

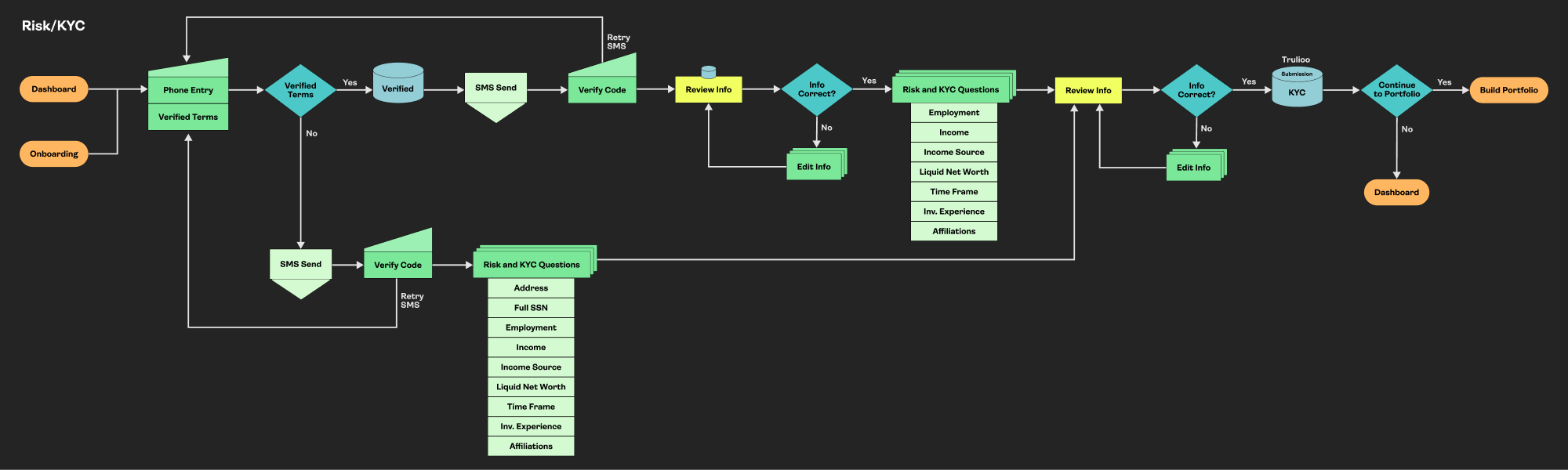

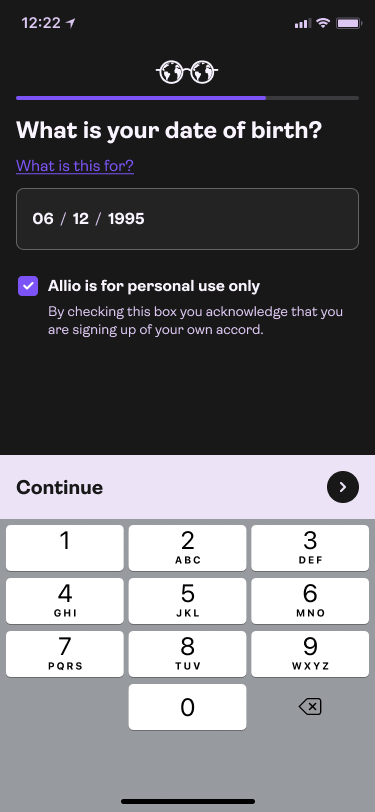

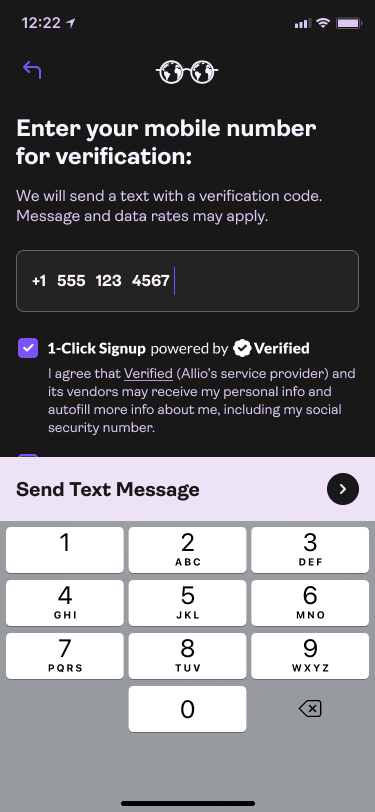

Fintech has some of the highest drop-offs in any products in the market. I knew the typical drop points from past experience (SSN, Banking, etc.), so I built trust early on. Allowing the clients to build and interact with the full application before asking for this sensitive data built trust. We created these intentional drops for clients to learn and explore made the onboarding feel more gradual as a whole.

Visual introduction with animations to entice and educate our clients first.

Adding terms to ensure scammers can’t take advantage of our clients.

Utilizing 3rd Party systems to pull in sensitive client data instead of asking for it.

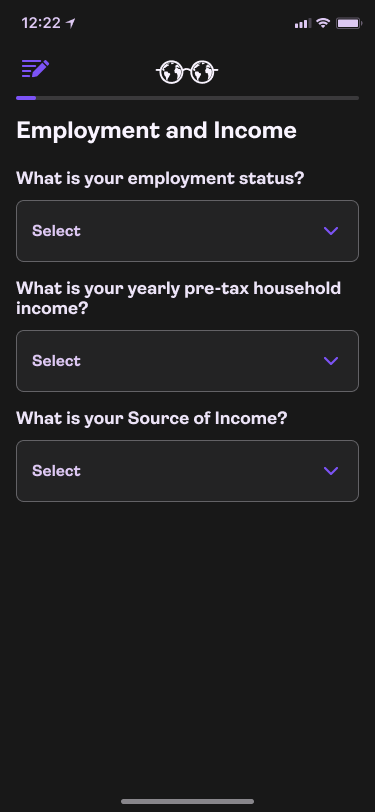

Simplifying standard KYC questions with fewer steps and clicks to cut fatigue.

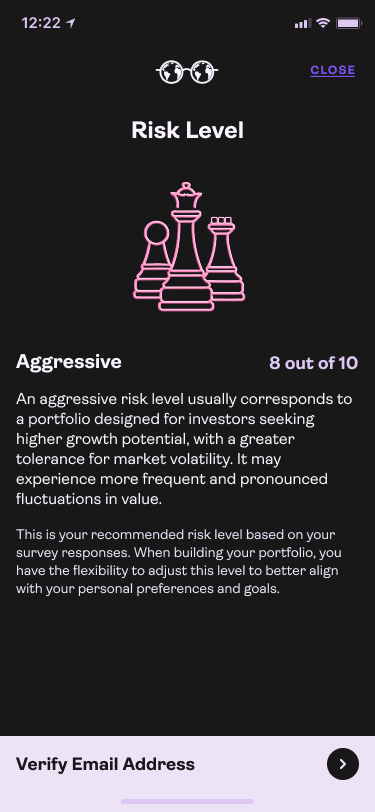

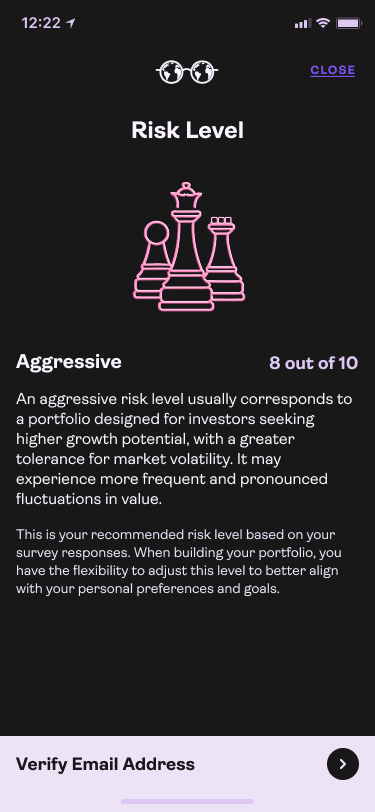

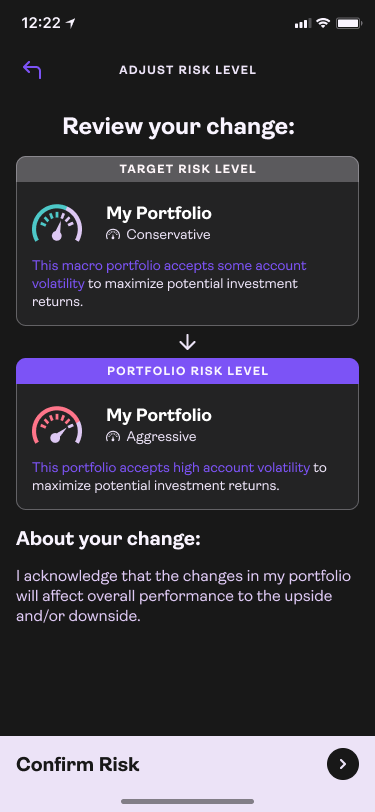

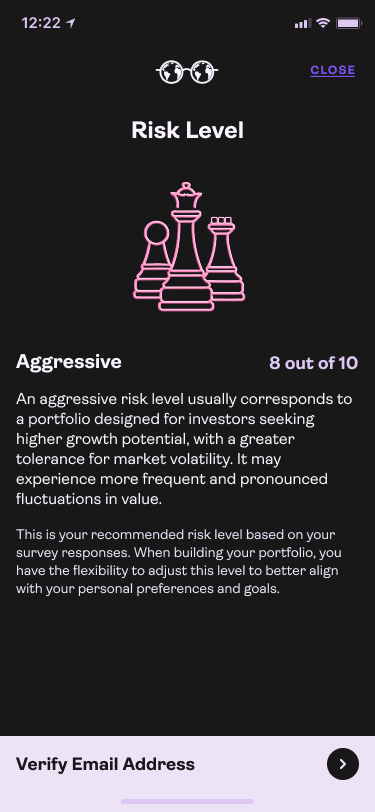

Utilizing all the client data we calculate their risk level and give them options to adjust.

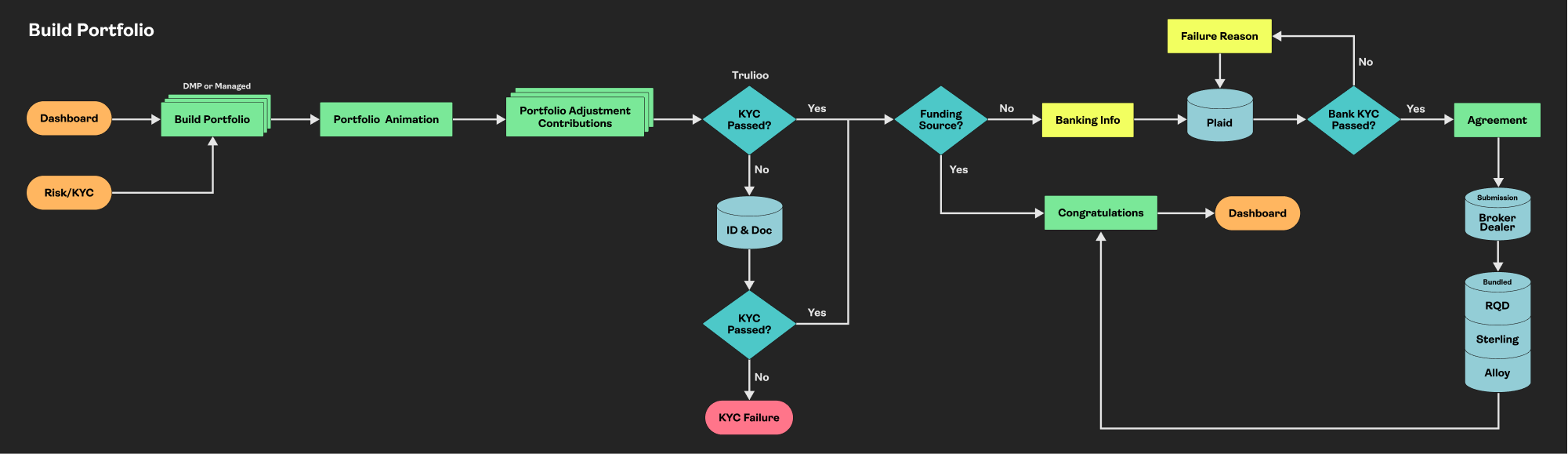

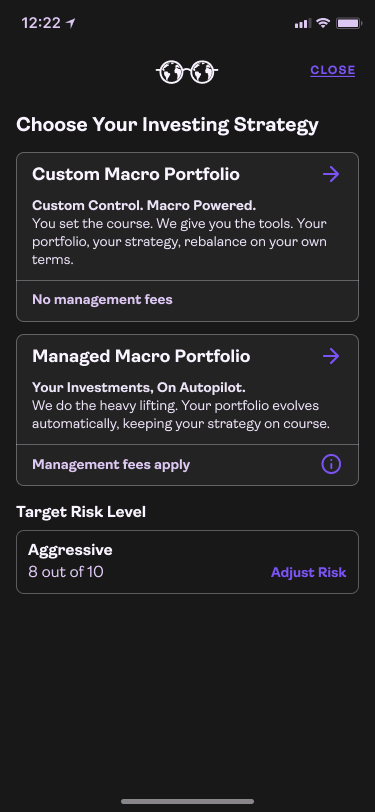

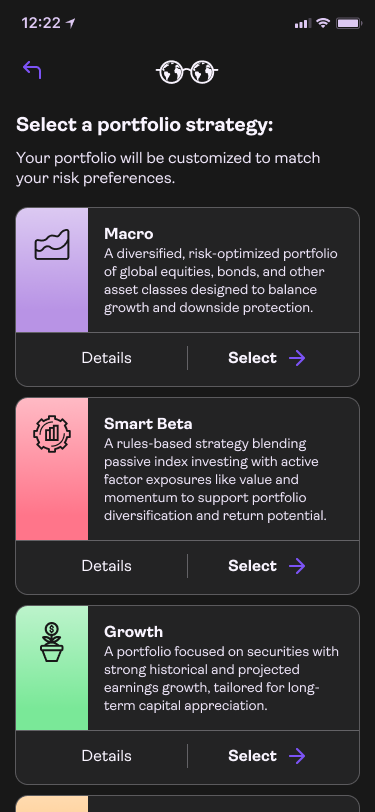

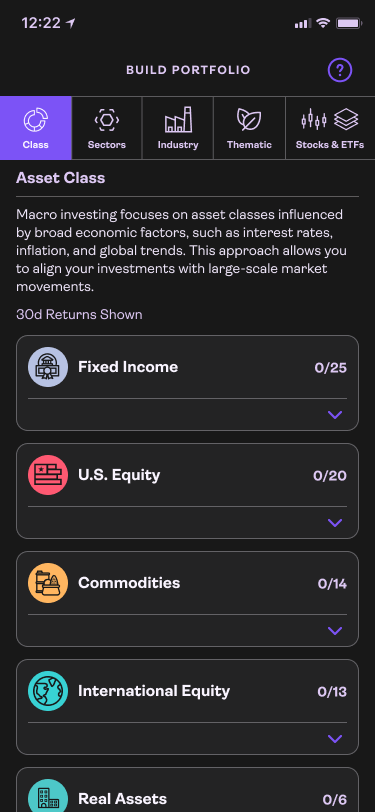

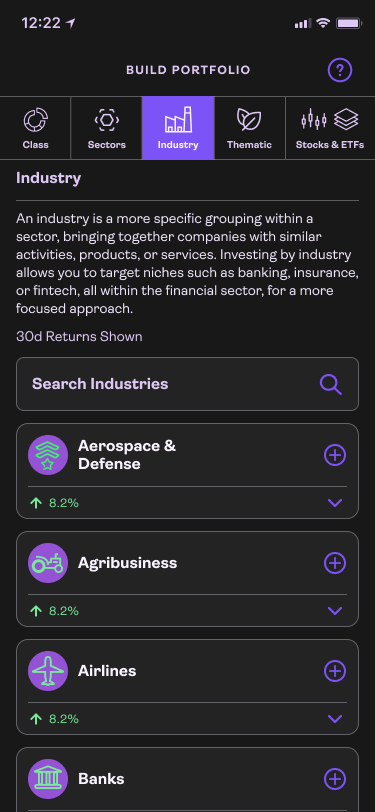

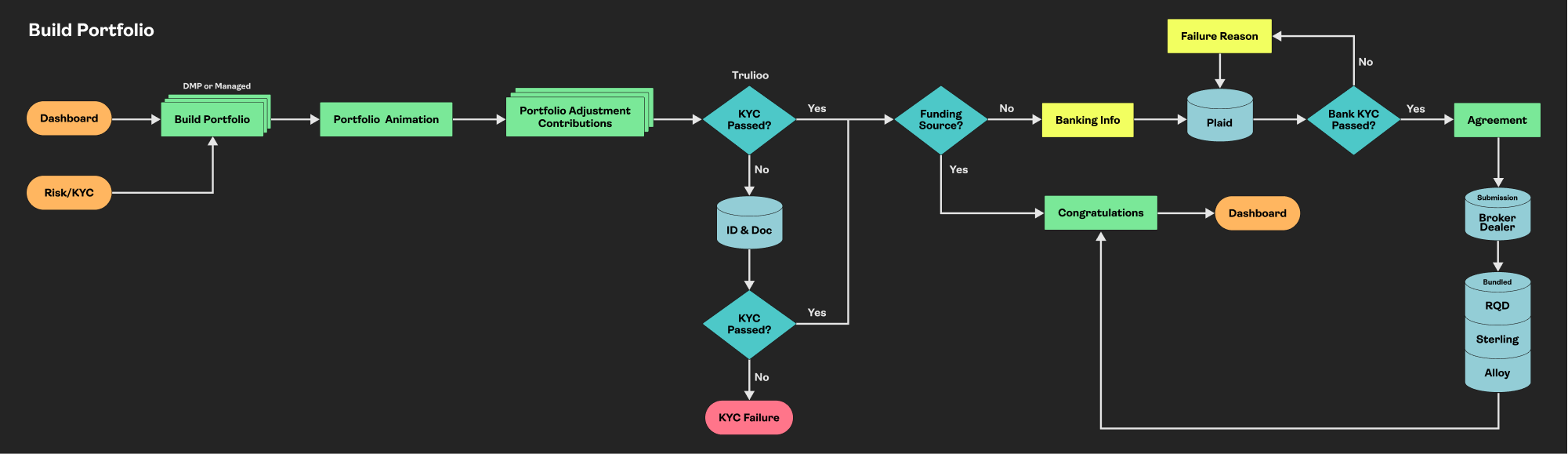

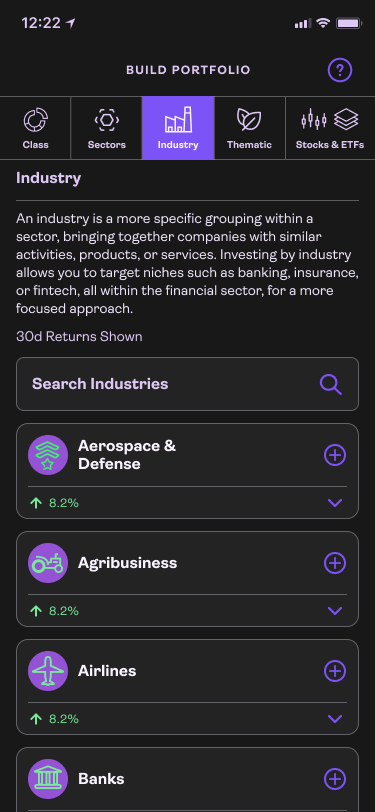

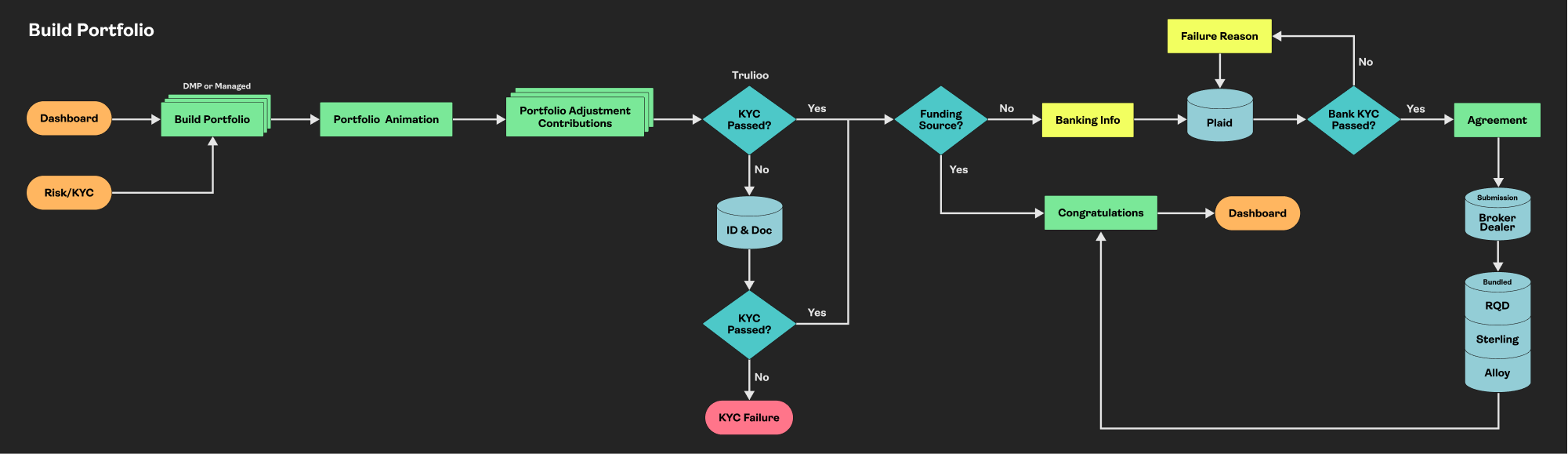

Build Portfolio

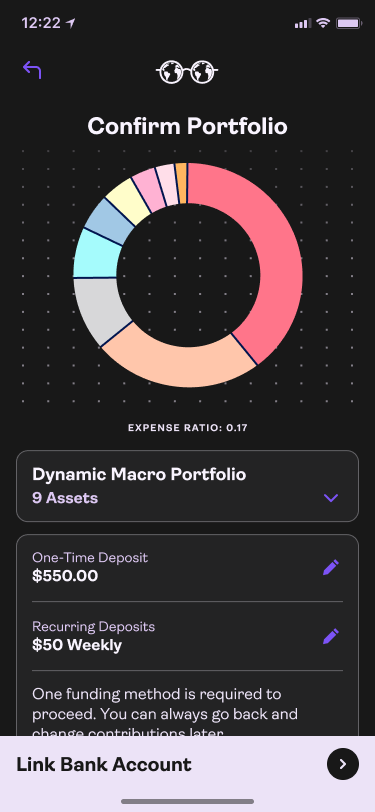

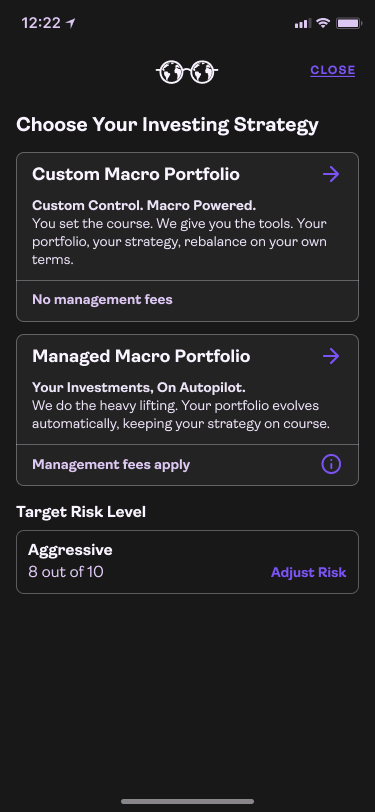

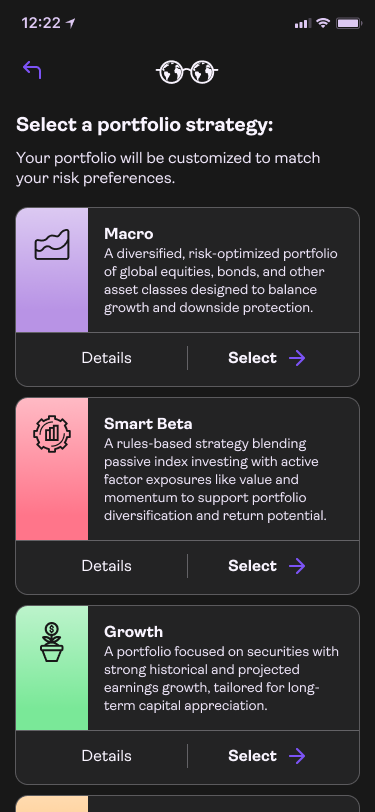

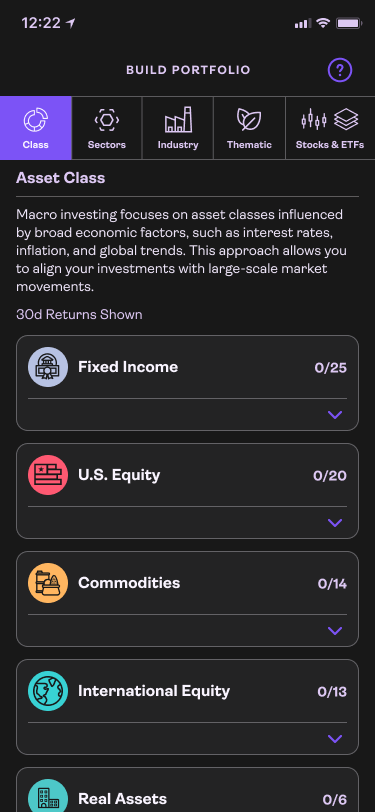

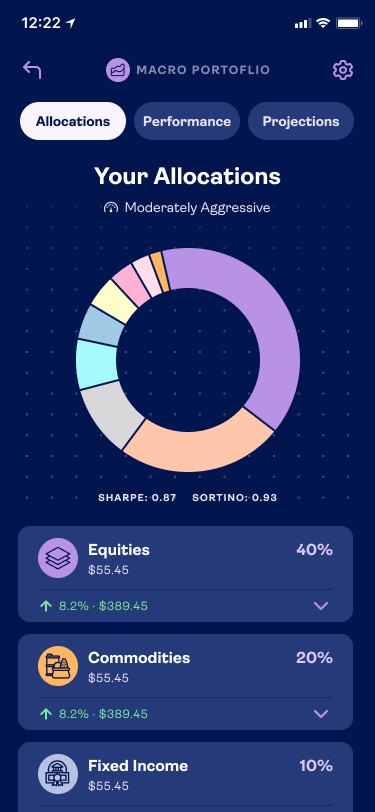

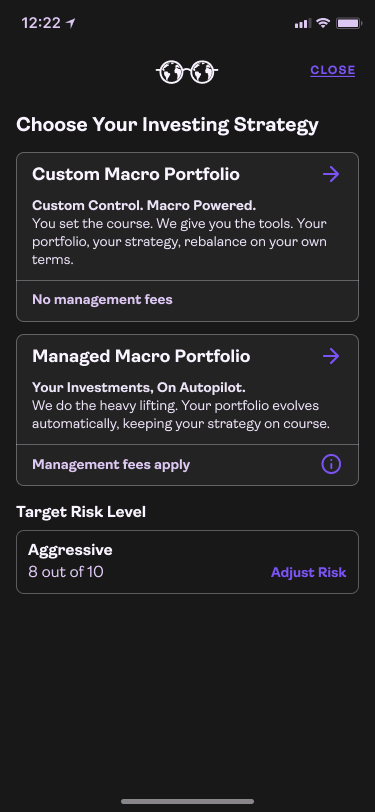

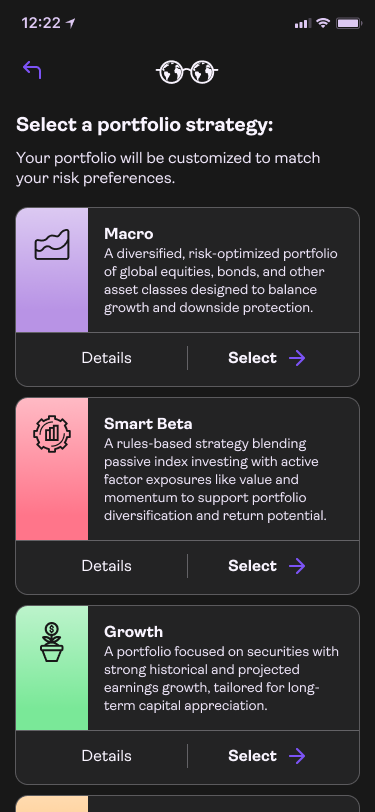

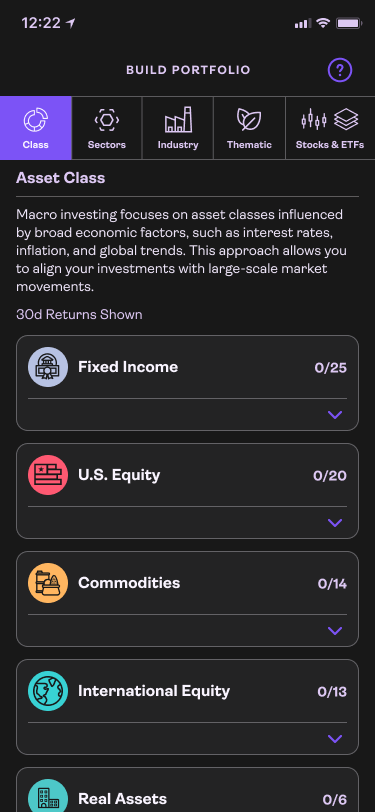

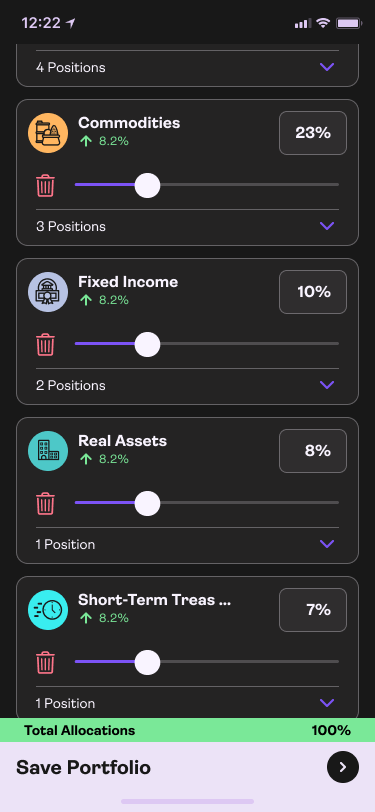

This product is not just for clients needing a managed portfolio, but giving them full customization with an intuitive structure. Macro investing was the base of our product; the structure of categories and assets aligns with those principle. Even after they add all their assets the AI works to align the portfolio to fit their risk level (they can supersede this as well and customize the allocations).

Splitting the clients into separate flows based on intent keeps the process simple.

Managed portfolios are not all the same, so a thorough breakdown helps the client.

Custom portfolios are built with a step by step process, starting with asset classes.

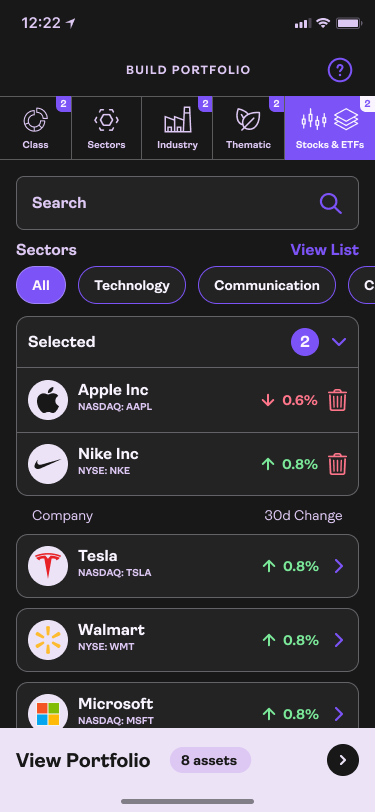

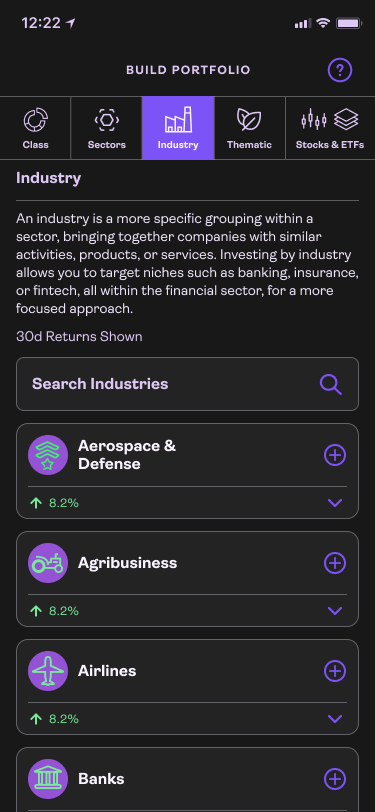

Instead of a client search for stocks and ETFs that fit industries we simplified.

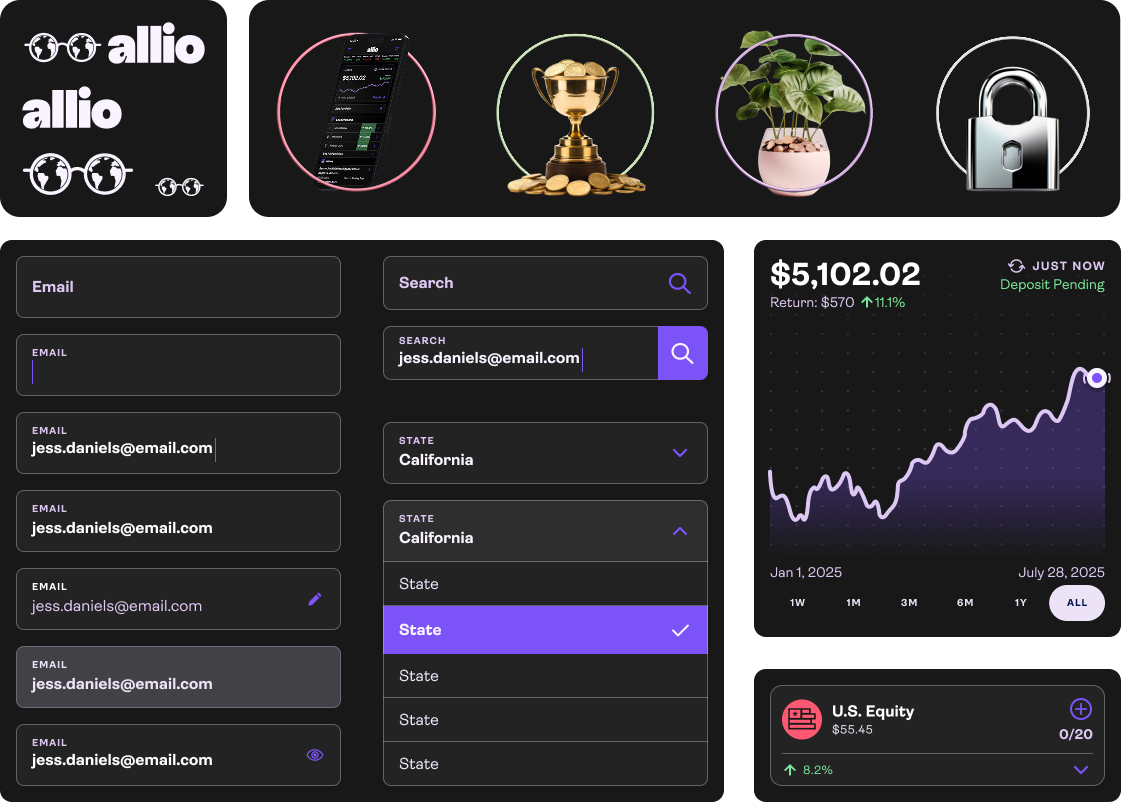

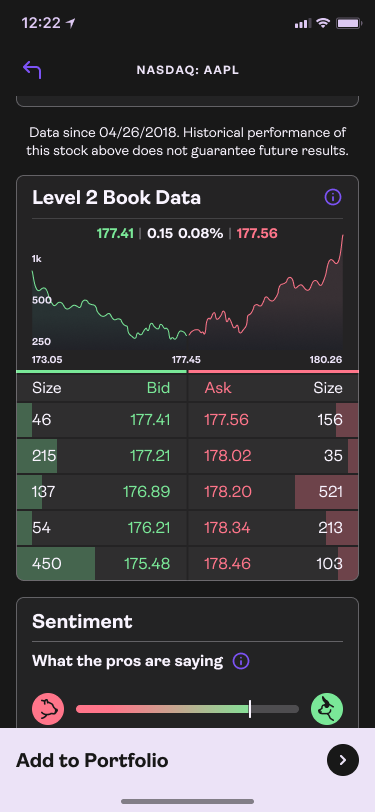

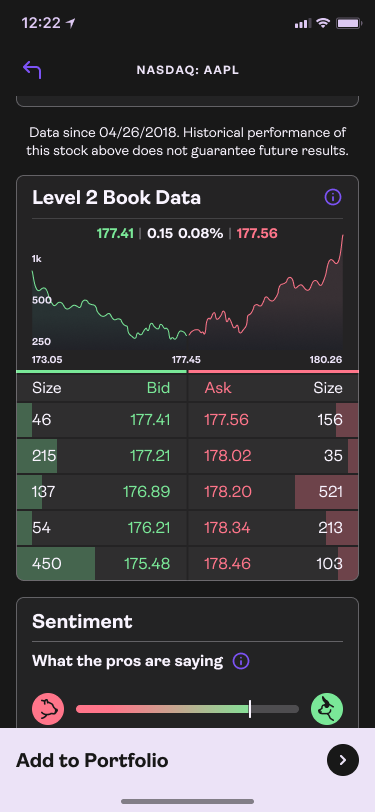

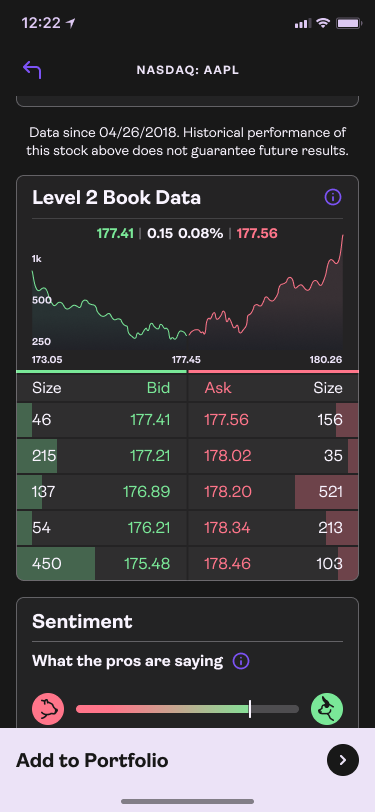

Detailed analysis is available for every stock and ETF, including Level 2 Book Data.

Technical charts allowing for even more detailed analysis is also available.

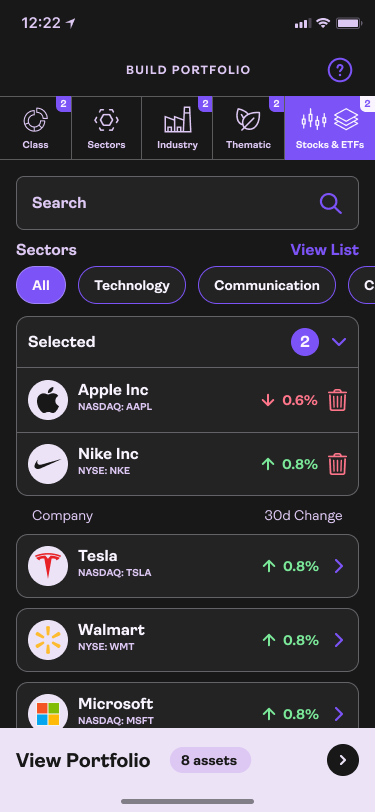

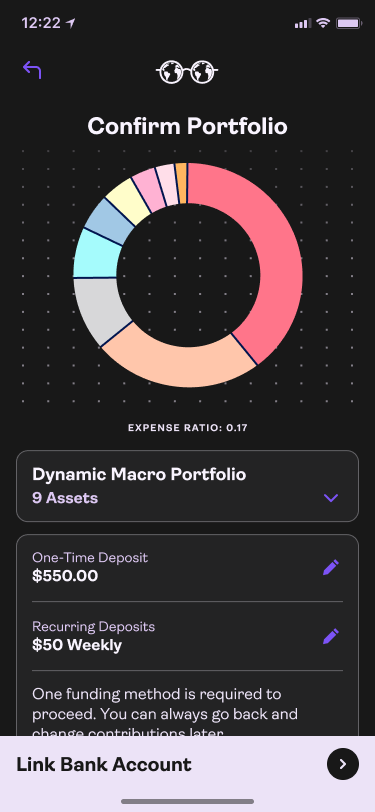

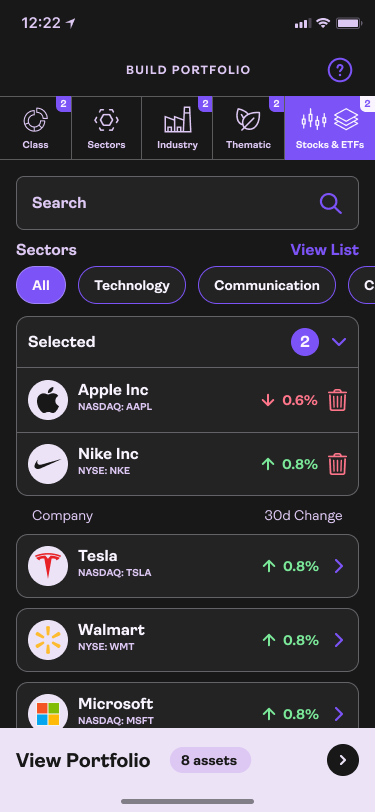

When assets are chosen it feels more like a checkout cart than a portfolio build.

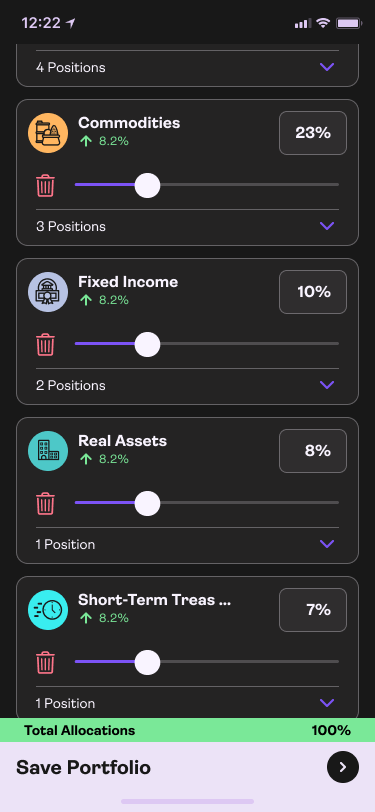

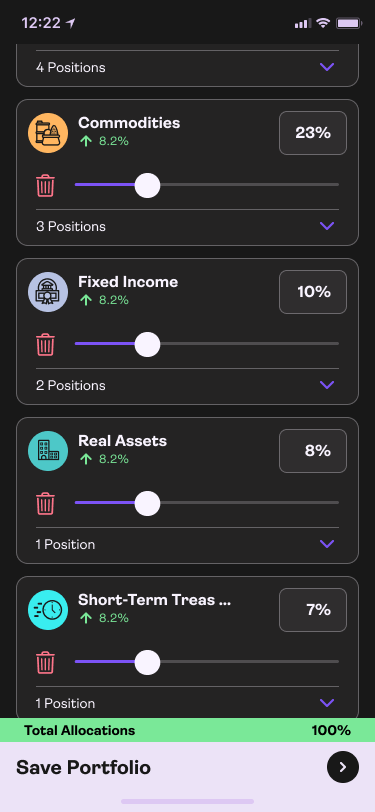

Allocations are initially calculated based on risk level, but customization is easy.

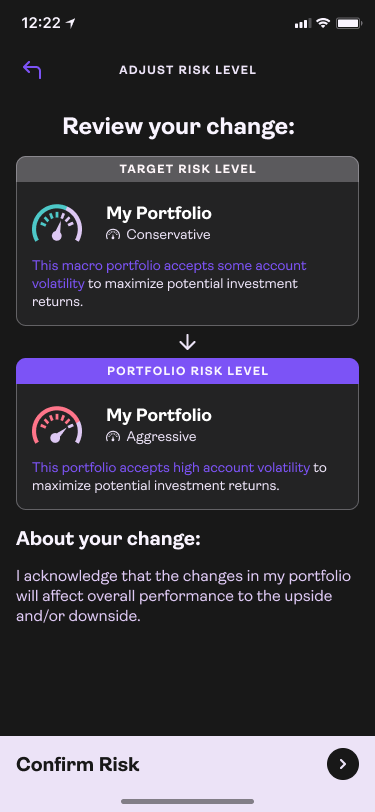

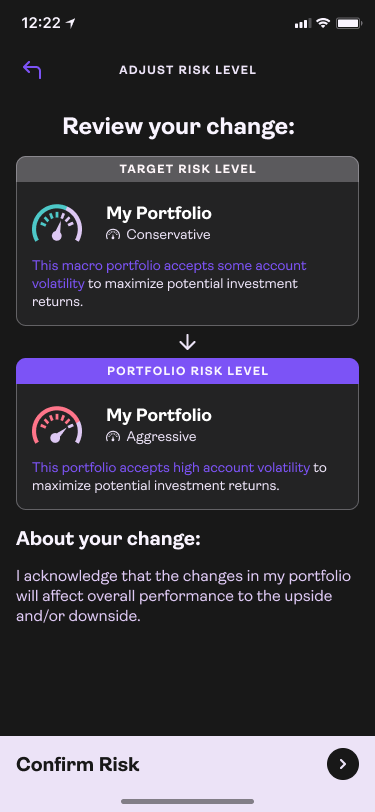

Risk education is crucial for a client’s future, so we always keep them informed.

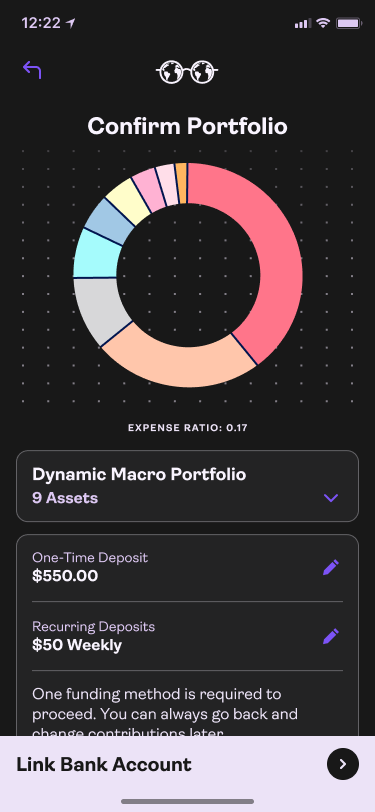

Reviewing everything at once is a nice way to visually conclude the build journey.

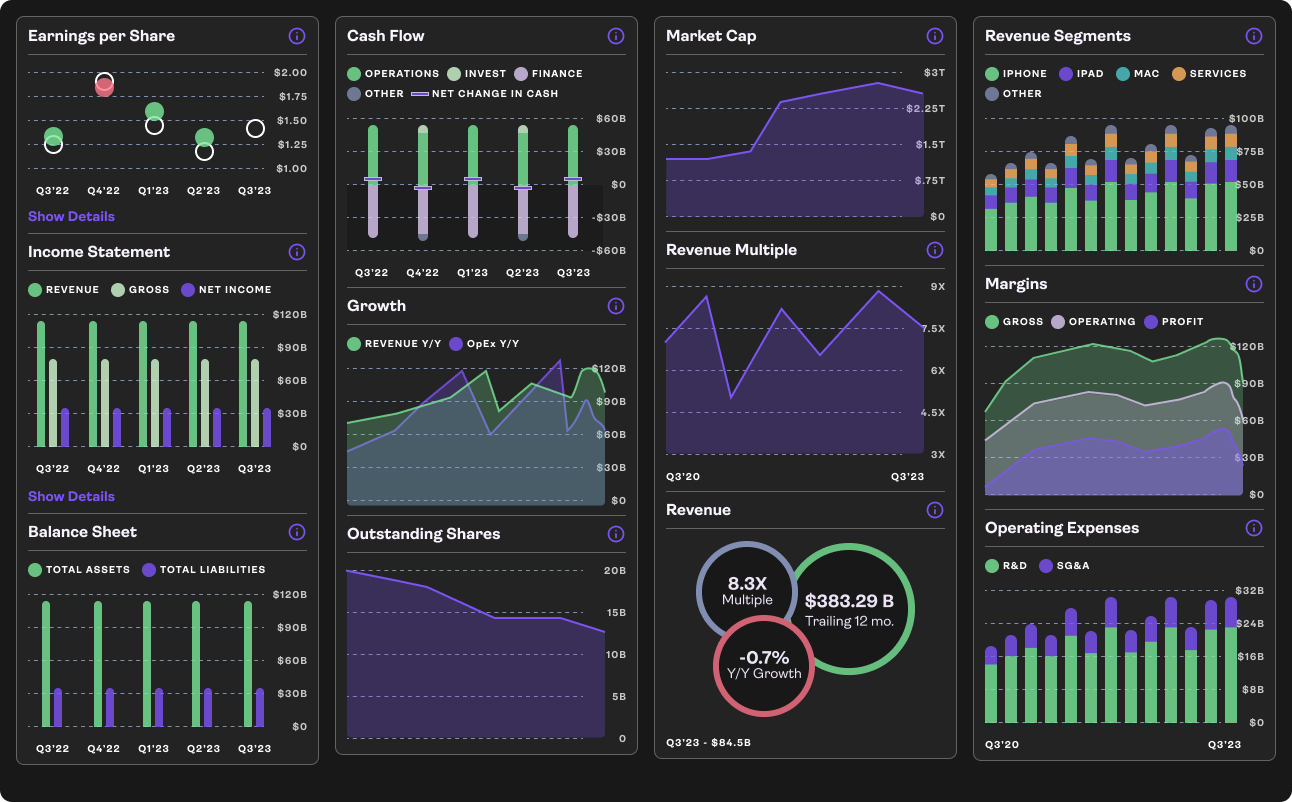

Invest and Learn

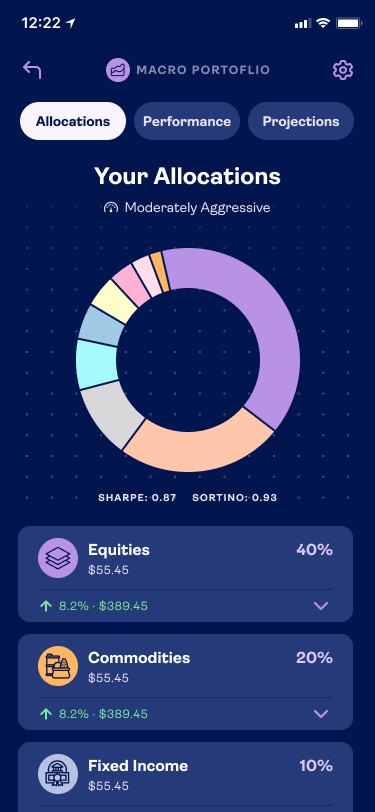

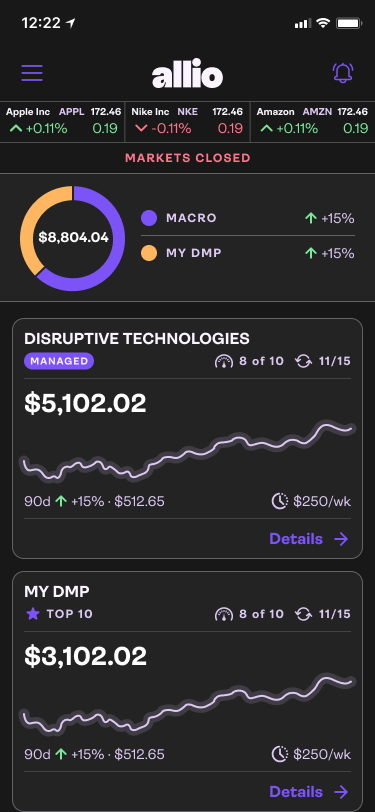

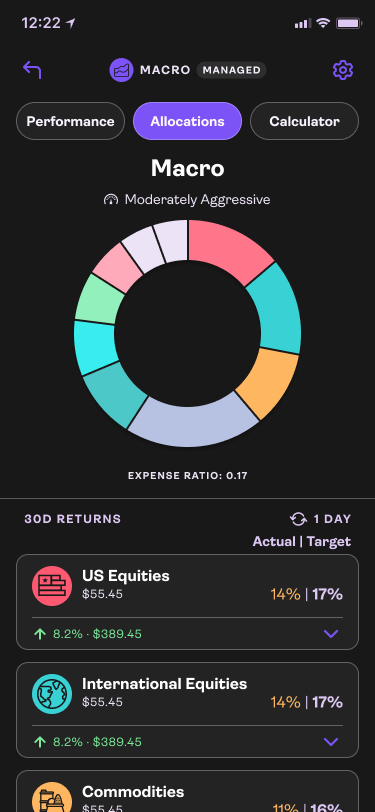

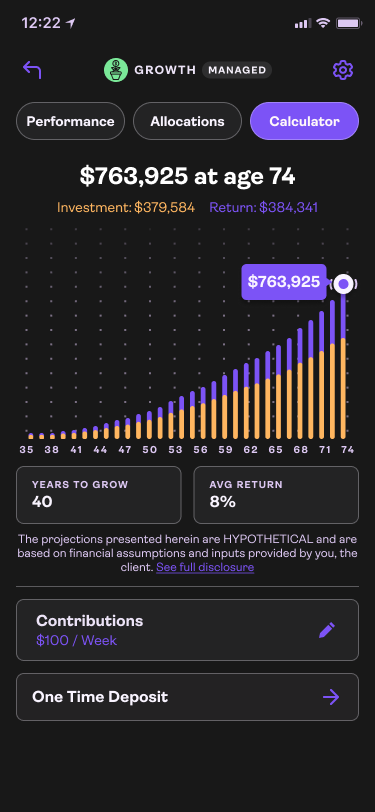

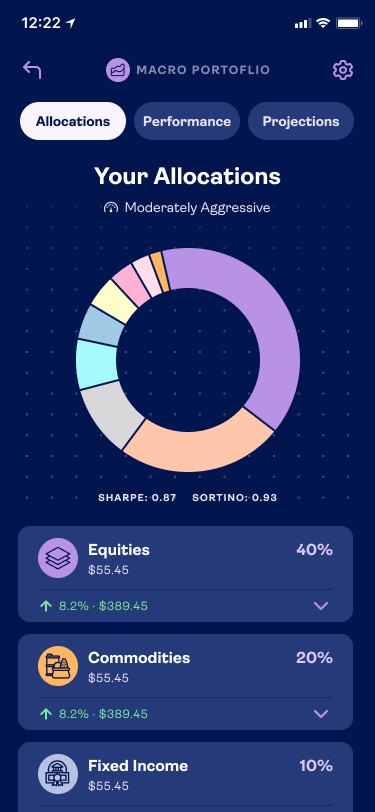

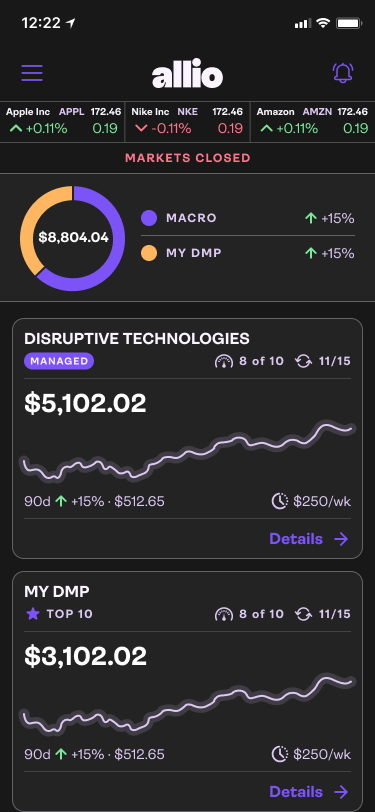

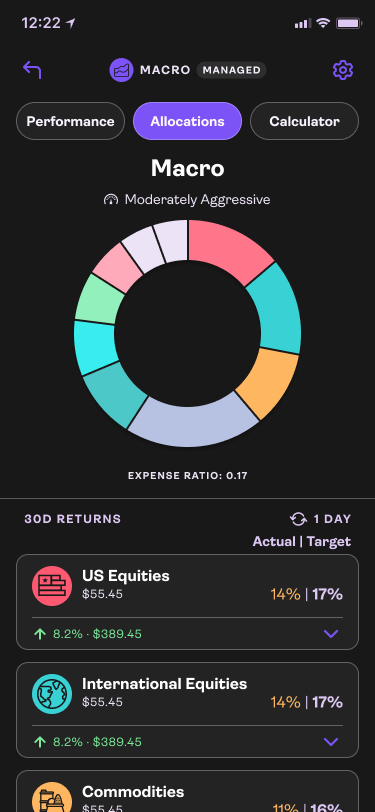

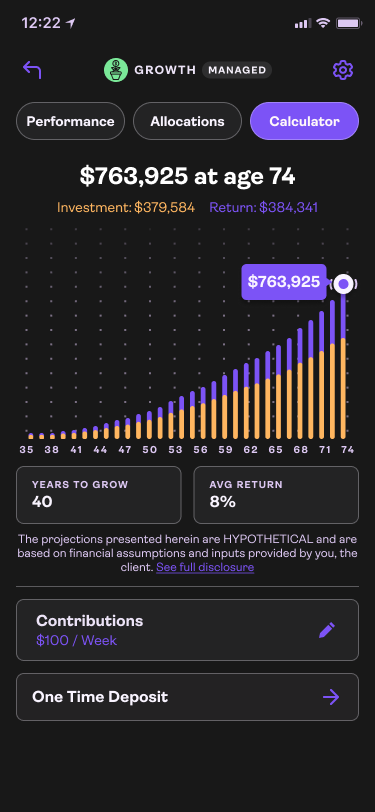

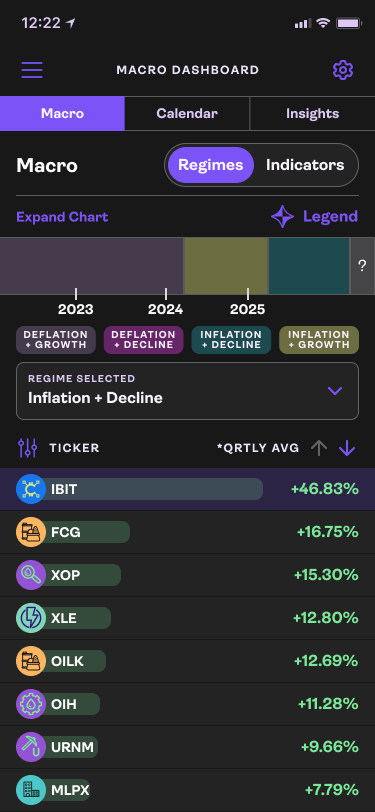

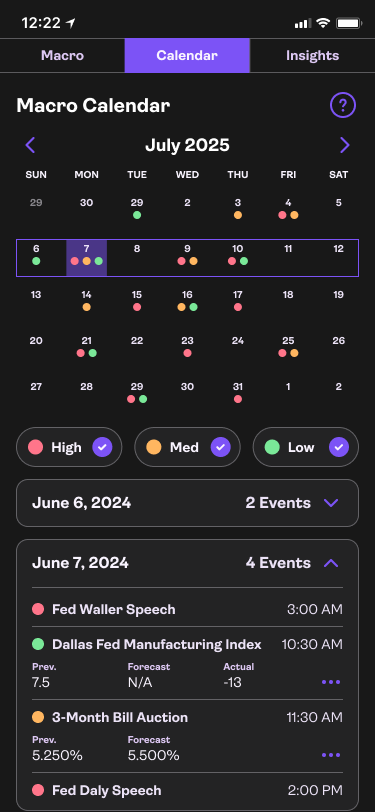

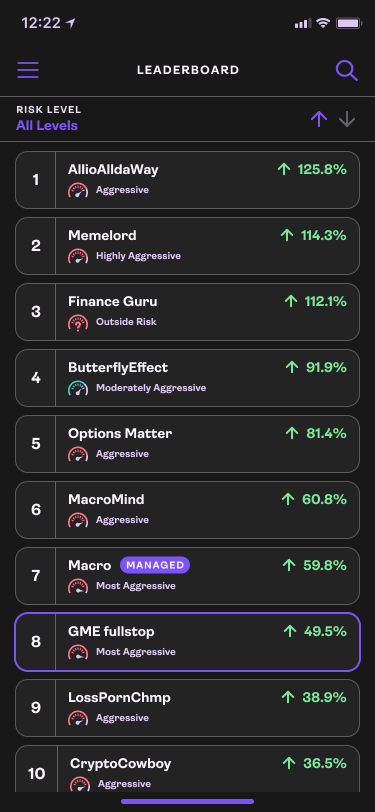

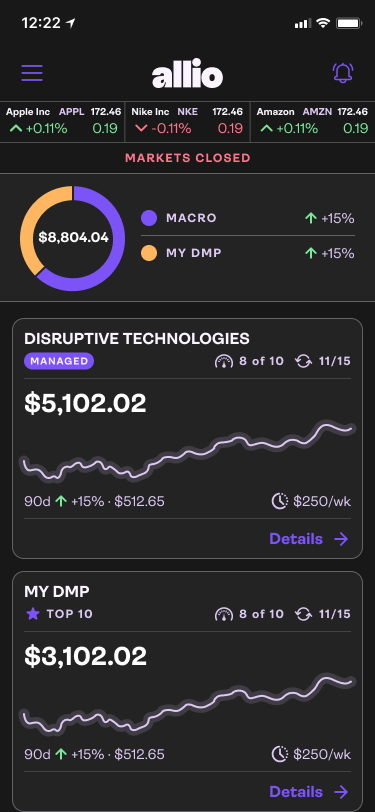

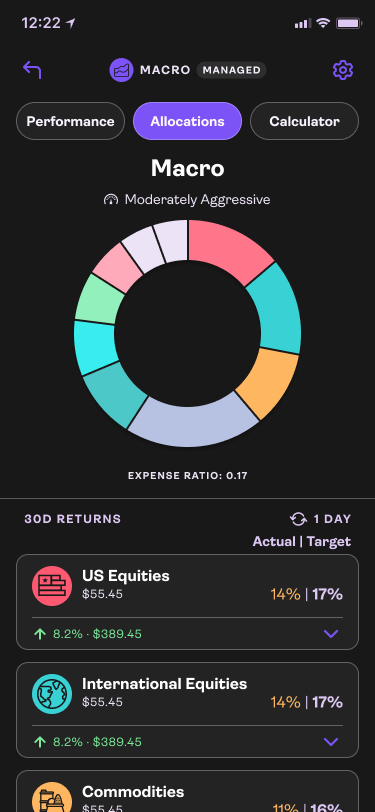

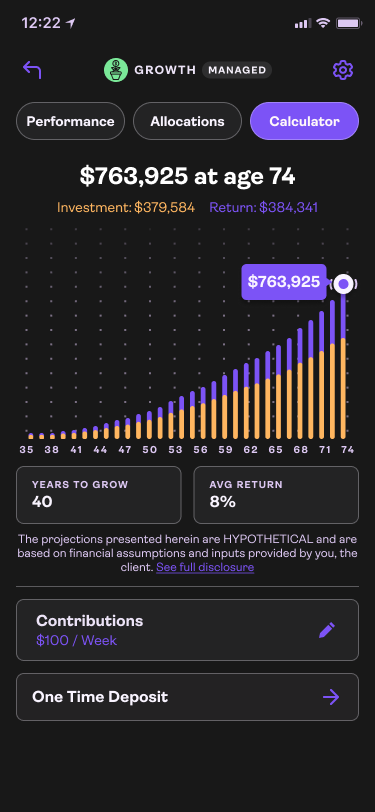

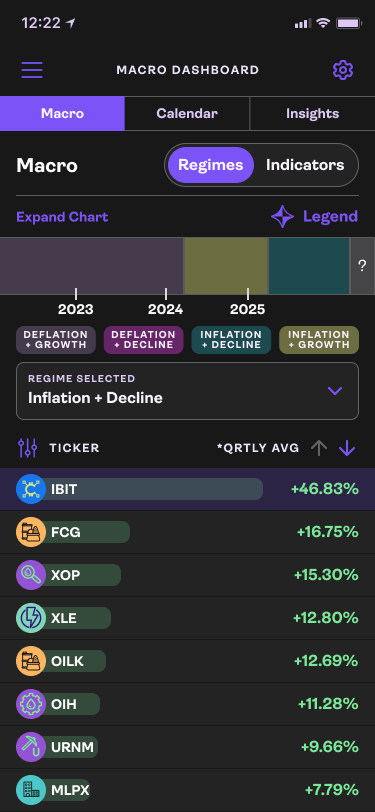

Monitoring your investments is crucial for a long term investor. They are not looking to switch up assets day to day but monthly changes to allocations is to be expected. Projecting out possible growth keeps the product sticky and increasing deposits. Market movements are also easier to grasp when you have a quick view in the Macro Dashboard.

We wanted to show all invested portfolios at once to encourage optionality in strategies.

Unlike other investing apps, we keep our clients looking ahead instead of daily gain/loss.

Allocations drill down to how each asset is performing and giving detailed insights.

The performance calculator is tied to the portfolio but adaptable to client input.

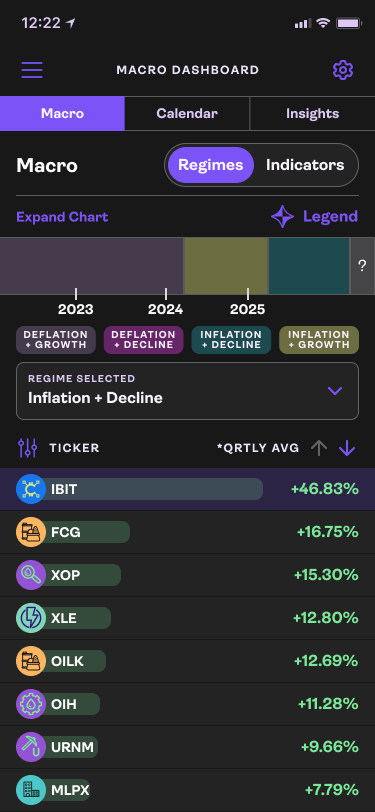

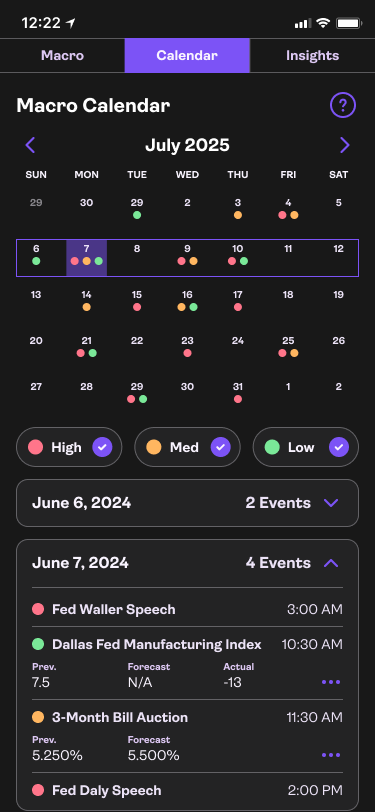

Macro Regimes are a base to macro investing, we can show ticker performance in each one.

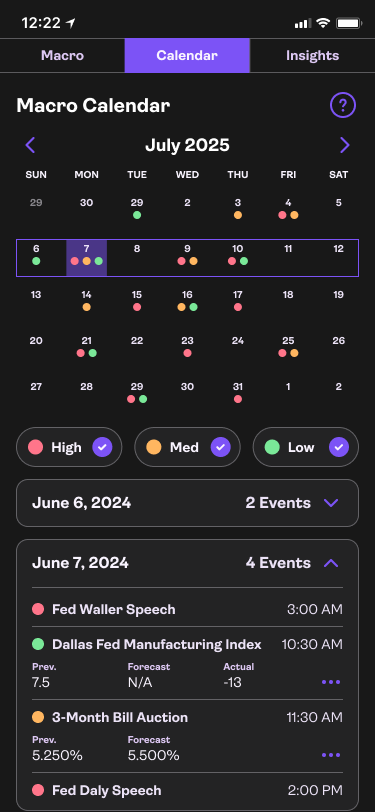

Standard investors tend not to tie releases to movement, we educate our clients on it.

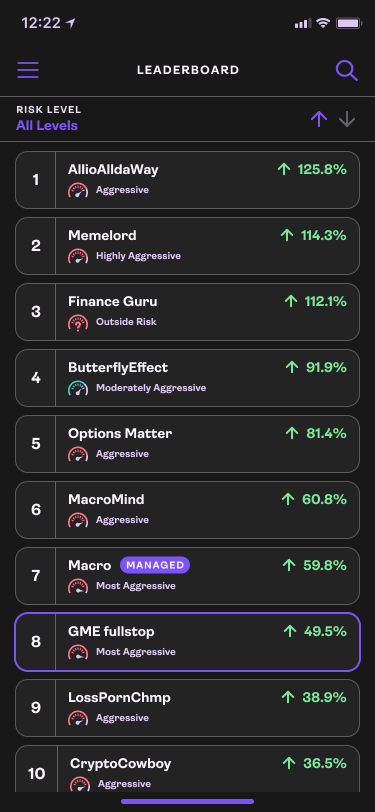

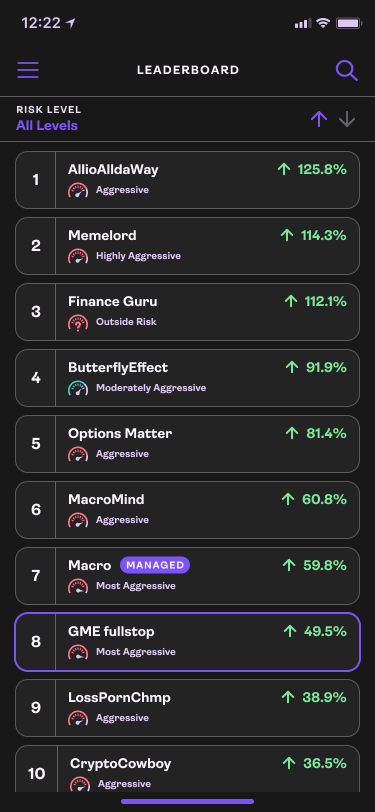

Nothing is better than seeing how you compare to other clients with similar goals.

Beta Walkthrough

This is a recording created to show other investors the functionality of the application and all the capabilities. Refinements to application continued even after this recording was taken as you can see from the design variations above.

Marketing Video

Results & Impact

56%

Onboarding growth

1250%

Deposit Increase

40%

MoM User Growth

- Enhanced user confidence through clearer AI-driven investment explanations and transparent macro insights.

- Reduced onboarding friction, accelerating time to first investment and improving early activation rates.

- More intuitive portfolio management, enabling users to understand and adjust strategies with ease.

- Greater engagement via a redesigned macro dashboard that connects economic signals to actionable insights.

- Improved retention through better education, clearer pathways, and a more predictable user experience.

- Stronger brand perception as a modern, sophisticated, and user-centric macro investing platform.

- Streamlined cross-team collaboration thanks to a unified design system and structured UX architecture.

- Faster development cycles with standardized components, patterns, and prototyping frameworks.

- Data-driven optimization loops enabling continuous improvement post-launch.

- A scalable UX foundation that supports future expansion into advanced AI features, broader asset classes, and new user segments.

Macro-Investing Made Human

UX Revamp of the Allio Capital Experience

Role: Director of UX

Initial Product

The initial product we released was for a younger audience, specifically the Gen-Z market. The product was created similar to other savings applications, but with better strategies. The objective of the original product was to help clients achieve financial goals while also investing in strategies that they believe in. All the strategies were managed and powered by our internal AI investment engine.

Project Overview

Allio Capital offers a unique value proposition: AI-powered macro investing, combining economic insight with portfolio strategy, via features such as the managed macro portfolio, dynamic macro portfolio, net-worth tracker and macro dashboard. We want to elevate the user experience across mobile and web to better serve both investor-savvy users and those newer to macro strategies; making high complexity feel intuitive and empowering.

Objectives & Success Metrics

Primary Goals

- Simplify onboarding and accelerate “first portfolio set-up” time (reduce friction).

- Increase user engagement with the macro dashboard & portfolio builder (deeper use of features).

- Improve trust and clarity in AI-driven decisions (transparency in ALTITUDE AI™ insights).

- Enhance retention and initial deposit metrics (e.g., first 30 days, month-to-month).

Key Metrics

- Drop-off rate during onboarding (–50%).

- Time from sign-up to first investment decision (reduce by 30%).

- Percentage of users who view the macro dashboard at least once per month (15%).

- Net-promoter score (NPS) for app usability and clarity of AI-explanations (+10pts).

- Retention rate at Day 30 and Day 90 (improvement vs current baseline).

Personas

Experienced investor

Comfortable with markets, wants advanced controls of sectors/themes; values data and speed.

Goal-oriented investor

Less focused on individual stocks, more interested in “set-and-forget” macro portfolios; values simplicity, trust, automation.

Macro-curious learner

New to macro investing; wants to understand “why” the portfolio is moving, not just “what”; needs education and clarity.

Client Journey

Design System & Components

Lottie Examples

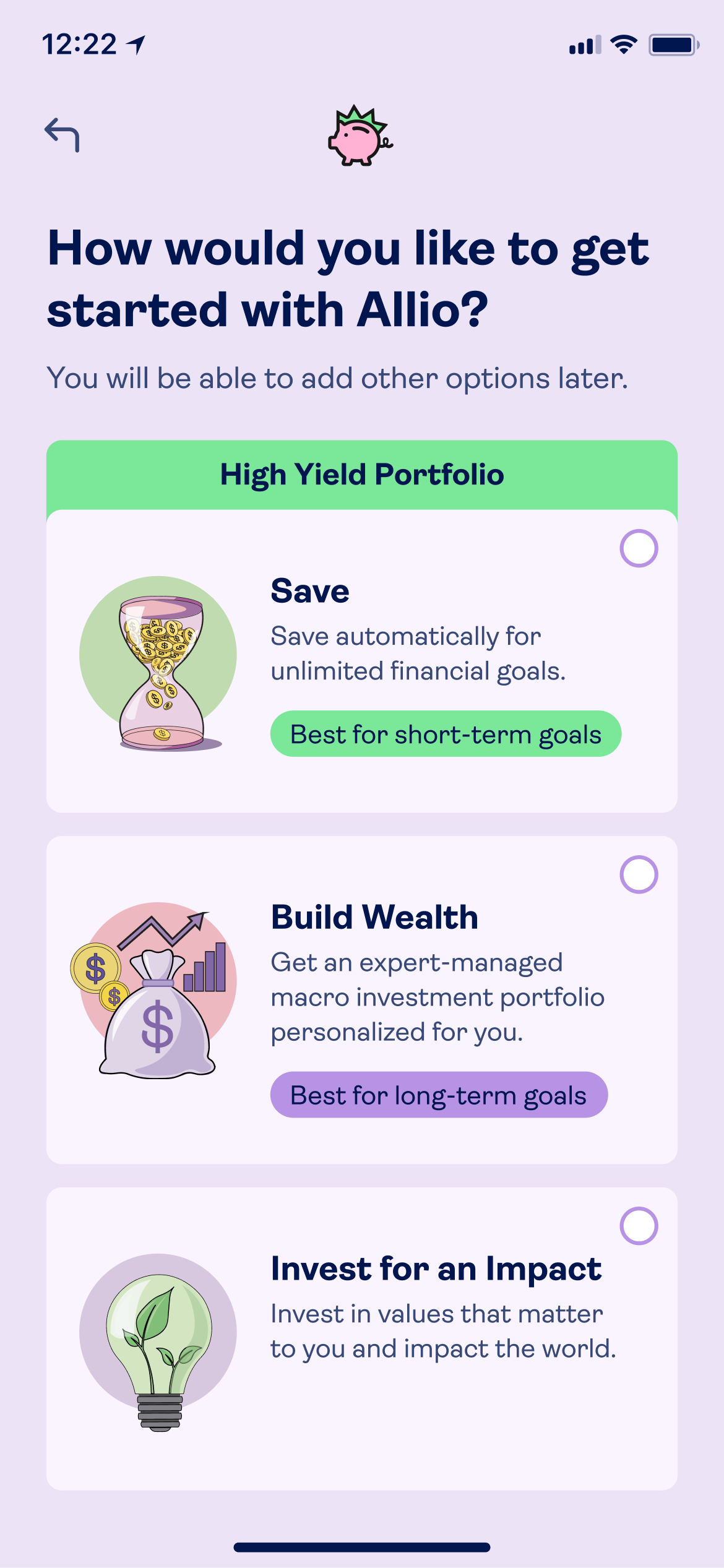

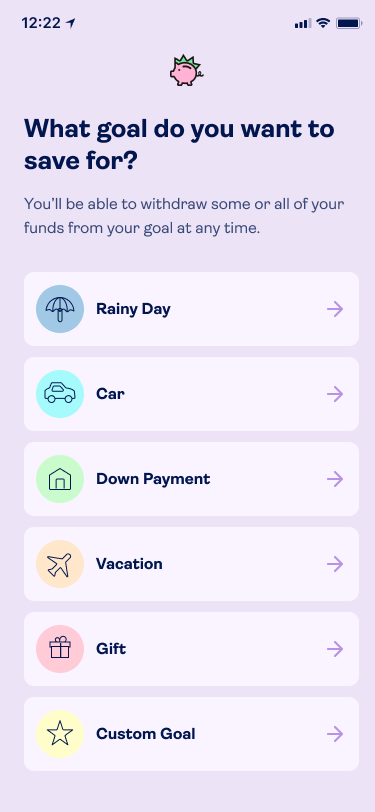

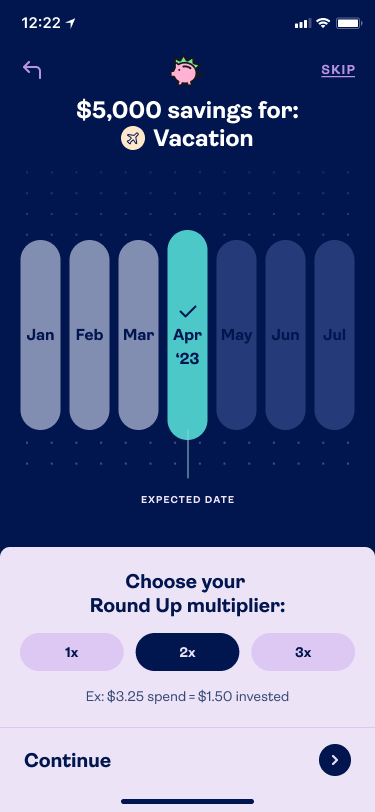

Onboarding

Fintech has some of the highest drop-offs in any products in the market. I knew the typical drop points from past experience (SSN, Banking, etc.), so I built trust early on. Allowing the clients to build and interact with the full application before asking for this sensitive data built trust. We created these intentional drops for clients to learn and explore made the onboarding feel more gradual as a whole.

Visual introduction with animations to entice and educate our clients first.

Adding terms to ensure scammers can’t take advantage of our clients.

Utilizing 3rd Party systems to pull in sensitive client data instead of asking for it.

Simplifying standard KYC questions with fewer steps and clicks to cut fatigue.

Utilizing all the client data we calculate their risk level and give them options to adjust.

Build Portfolio

This product is not just for clients needing a managed portfolio, but giving them full customization with an intuitive structure. Macro investing was the base of our product; the structure of categories and assets aligns with those principle. Even after they add all their assets the AI works to align the portfolio to fit their risk level (they can supersede this as well and customize the allocations).

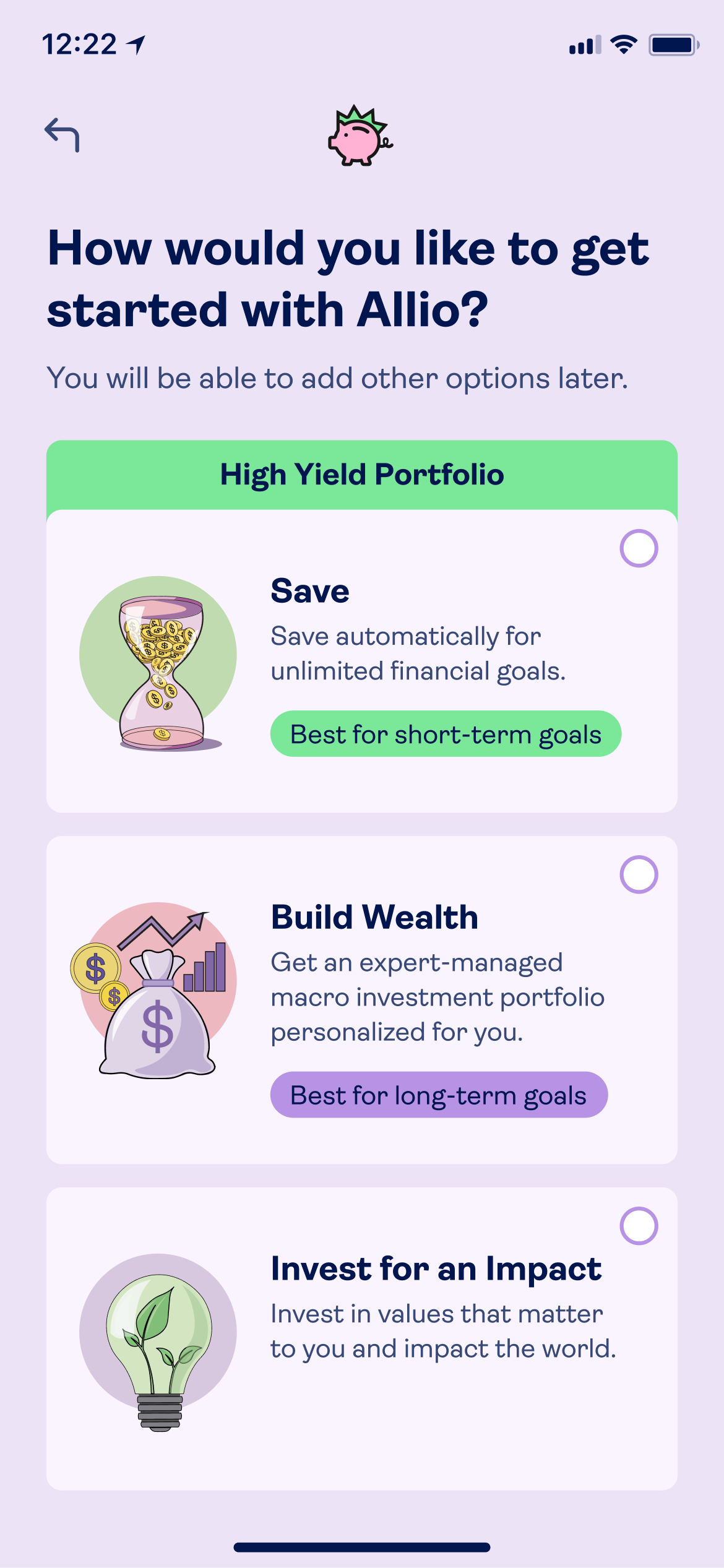

Splitting the clients into separate flows based on intent keeps the process simple.

Managed portfolios are not all the same, so a thorough breakdown helps the client.

Custom portfolios are built with a step by step process, starting with asset classes.

Instead of a client search for stocks and ETFs that fit industries we simplified.

Detailed analysis is available for every stock and ETF, including Level 2 Book Data.

Technical charts allowing for even more detailed analysis is also available.

When assets are chosen it feels more like a checkout cart than a portfolio build.

Allocations are initially calculated based on risk level, but customization is easy.

Risk education is crucial for a client’s future, so we always keep them informed.

Reviewing everything at once is a nice way to visually conclude the build journey.

Invest and Learn

Monitoring your investments is crucial for a long term investor. They are not looking to switch up assets day to day but monthly changes to allocations is to be expected. Projecting out possible growth keeps the product sticky and increasing deposits. Market movements are also easier to grasp when you have a quick view in the Macro Dashboard.

We wanted to show all invested portfolios at once to encourage optionality in strategies.

Unlike other investing apps, we keep our clients looking ahead instead of daily gain/loss.

Allocations drill down to how each asset is performing and giving detailed insights.

The performance calculator is tied to the portfolio but adaptable to client input.

Macro Regimes are a base to macro investing, we can show ticker performance in each one.

Standard investors tend not to tie releases to movement, we educate our clients on it.

Nothing is better than seeing how you compare to other clients with similar goals.

Beta Walkthrough

This is a recording created to show other investors the functionality of the application and all the capabilities. Refinements to application continued even after this recording was taken as you can see from the design variations above.

Marketing Video

Results & Impact

56%

Onboarding growth

1250%

Deposit Increase

40%

MoM User Growth

- Enhanced user confidence through clearer AI-driven investment explanations and transparent macro insights.

- Reduced onboarding friction, accelerating time to first investment and improving early activation rates.

- More intuitive portfolio management, enabling users to understand and adjust strategies with ease.

- Greater engagement via a redesigned macro dashboard that connects economic signals to actionable insights.

- Improved retention through better education, clearer pathways, and a more predictable user experience.

- Stronger brand perception as a modern, sophisticated, and user-centric macro investing platform.

- Streamlined cross-team collaboration thanks to a unified design system and structured UX architecture.

- Faster development cycles with standardized components, patterns, and prototyping frameworks.

- Data-driven optimization loops enabling continuous improvement post-launch.

- A scalable UX foundation that supports future expansion into advanced AI features, broader asset classes, and new user segments.

Macro-Investing Made Human

UX Revamp of the Allio Capital Experience

Role: Director of UX

Initial Product

The initial product we released was for a younger audience, specifically the Gen-Z market. The product was created similar to other savings applications, but with better strategies. The objective of the original product was to help clients achieve financial goals while also investing in strategies that they believe in. All the strategies were managed and powered by our internal AI investment engine.

Project Overview

Allio Capital offers a unique value proposition: AI-powered macro investing, combining economic insight with portfolio strategy, via features such as the managed macro portfolio, dynamic macro portfolio, net-worth tracker and macro dashboard. We want to elevate the user experience across mobile and web to better serve both investor-savvy users and those newer to macro strategies; making high complexity feel intuitive and empowering.

Objectives & Success Metrics

Primary Goals

- Simplify onboarding and accelerate “first portfolio set-up” time (reduce friction).

- Increase user engagement with the macro dashboard & portfolio builder (deeper use of features).

- Improve trust and clarity in AI-driven decisions (transparency in ALTITUDE AI™ insights).

- Enhance retention and initial deposit metrics (e.g., first 30 days, month-to-month).

Key Metrics

- Drop-off rate during onboarding (–50%).

- Time from sign-up to first investment decision (reduce by 30%).

- Percentage of users who view the macro dashboard at least once per month (15%).

- Net-promoter score (NPS) for app usability and clarity of AI-explanations (+10pts).

- Retention rate at Day 30 and Day 90 (improvement vs current baseline).

Personas

Experienced investor

Comfortable with markets, wants advanced controls of sectors/themes; values data and speed.

Goal-oriented investor

Less focused on individual stocks, more interested in “set-and-forget” macro portfolios; values simplicity, trust, automation.

Macro-curious learner

New to macro investing; wants to understand “why” the portfolio is moving, not just “what”; needs education and clarity.

Client Journey

Design System & Components

Lottie Examples

Onboarding

Fintech has some of the highest drop-offs in any products in the market. I knew the typical drop points from past experience (SSN, Banking, etc.), so I built trust early on. Allowing the clients to build and interact with the full application before asking for this sensitive data built trust. We created these intentional drops for clients to learn and explore made the onboarding feel more gradual as a whole.

Visual introduction with animations to entice and educate our clients first.

Adding terms to ensure scammers can’t take advantage of our clients.

Utilizing 3rd Party systems to pull in sensitive client data instead of asking for it.

Simplifying standard KYC questions with fewer steps and clicks to cut fatigue.

Utilizing all the client data we calculate their risk level and give them options to adjust.

Build Portfolio

This product is not just for clients needing a managed portfolio, but giving them full customization with an intuitive structure. Macro investing was the base of our product; the structure of categories and assets aligns with those principle. Even after they add all their assets the AI works to align the portfolio to fit their risk level (they can supersede this as well and customize the allocations).

Splitting the clients into separate flows based on intent keeps the process simple.

Managed portfolios are not all the same, so a thorough breakdown helps the client.

Custom portfolios are built with a step by step process, starting with asset classes.

Instead of a client search for stocks and ETFs that fit industries we simplified.

Detailed analysis is available for every stock and ETF, including Level 2 Book Data.

Technical charts allowing for even more detailed analysis is also available.

When assets are chosen it feels more like a checkout cart than a portfolio build.

Allocations are initially calculated based on risk level, but customization is easy.

Risk education is crucial for a client’s future, so we always keep them informed.

Reviewing everything at once is a nice way to visually conclude the build journey.

Invest and Learn

Monitoring your investments is crucial for a long term investor. They are not looking to switch up assets day to day but monthly changes to allocations is to be expected. Projecting out possible growth keeps the product sticky and increasing deposits. Market movements are also easier to grasp when you have a quick view in the Macro Dashboard.

We wanted to show all invested portfolios at once to encourage optionality in strategies.

Unlike other investing apps, we keep our clients looking ahead instead of daily gain/loss.

Allocations drill down to how each asset is performing and giving detailed insights.

The performance calculator is tied to the portfolio but adaptable to client input.

Macro Regimes are a base to macro investing, we can show ticker performance in each one.

Standard investors tend not to tie releases to movement, we educate our clients on it.

Nothing is better than seeing how you compare to other clients with similar goals.

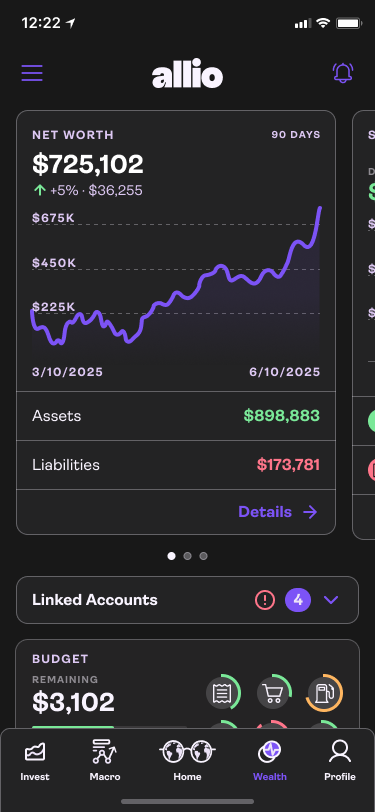

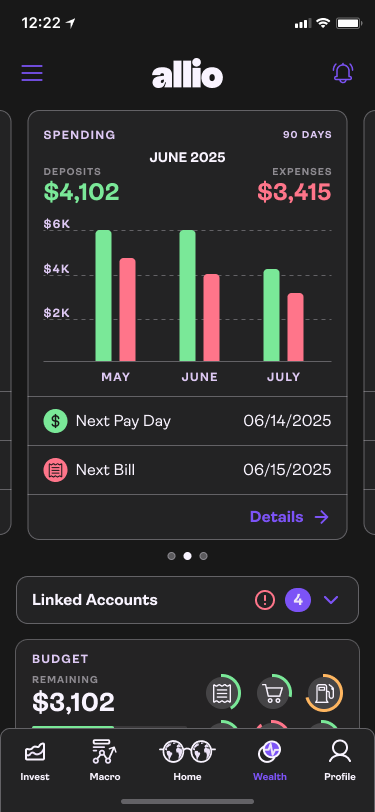

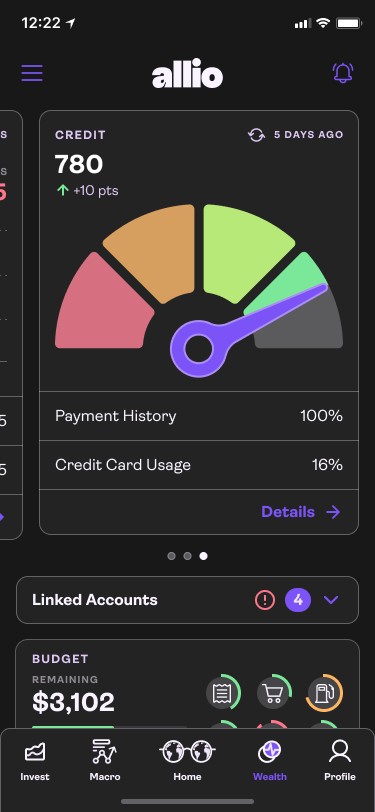

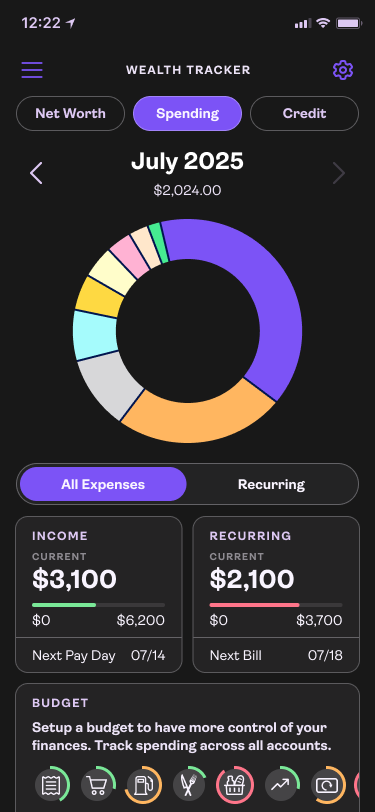

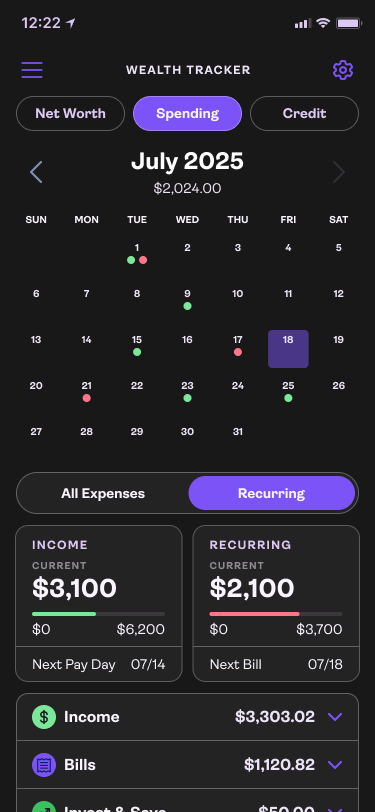

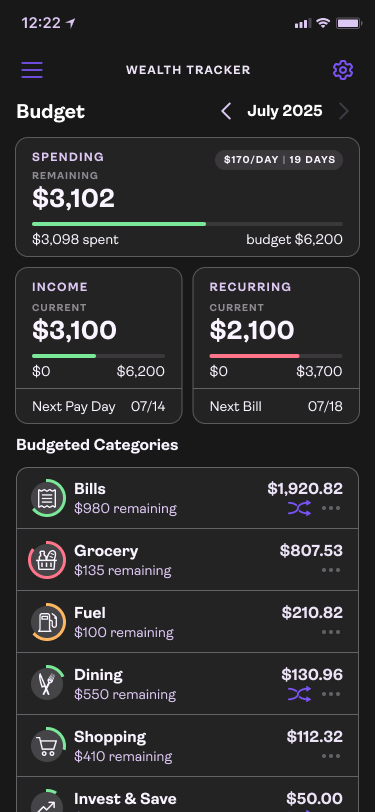

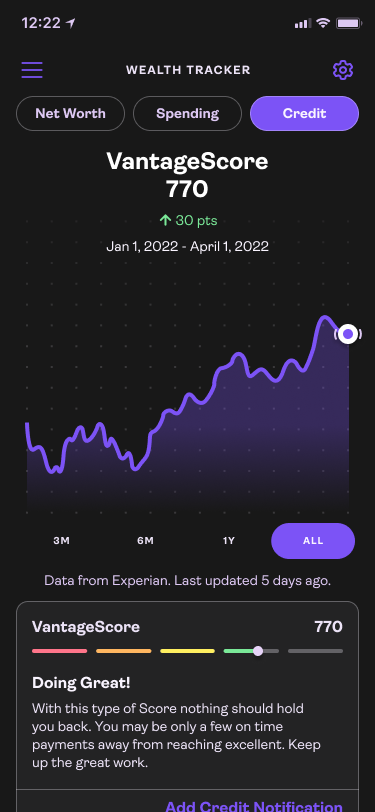

Track and Grow

Clients can’t usually invest well unless they have a good base on their finances, so we built the Wealth Tracker. Their net worth, spending, and credit are all monitored in one place. Building a budget is as intuitive as making sure the accounts are synced with Plaid and they are ready to go.

Wealth Tracker Dashboard:Net worth is the first glimpse in their financial health.

Wealth Tracker Dashboard:Spending summary gives a quick view into habits.

Wealth Tracker Dashboard:Credit monitoring shows long term financial responsibility.

Net worth details are organized in groups to simplify where their wealth is at a given point.

Spending looks at the day to day habits to provide a better decision making.

All recurring payments or deposits help predict what is to come and prepare.

Budgeting is simple to setup and customize to keep more money invested for longer.

Credit monitoring shows not only where their score is but how it is calculated.

Beta Walkthrough

This is a recording created to show other investors the functionality of the application and all the capabilities. Refinements to application continued even after this recording was taken as you can see from the design variations above.

Marketing Video

Results & Impact

56%

Onboarding growth

1250%

Deposit Increase

40%

MoM User Growth

- Enhanced user confidence through clearer AI-driven investment explanations and transparent macro insights.

- Reduced onboarding friction, accelerating time to first investment and improving early activation rates.

- More intuitive portfolio management, enabling users to understand and adjust strategies with ease.

- Greater engagement via a redesigned macro dashboard that connects economic signals to actionable insights.

- Improved retention through better education, clearer pathways, and a more predictable user experience.

- Stronger brand perception as a modern, sophisticated, and user-centric macro investing platform.

- Streamlined cross-team collaboration thanks to a unified design system and structured UX architecture.

- Faster development cycles with standardized components, patterns, and prototyping frameworks.

- Data-driven optimization loops enabling continuous improvement post-launch.

- A scalable UX foundation that supports future expansion into advanced AI features, broader asset classes, and new user segments.